The $180 Billion Reversal: What the SCOTUS Tariff Ruling Actually Means for the Future

Feb 20, 2026 /Mpelembe media/ — On February 20, 2026, the U.S. Supreme Court issued a landmark 6-3 decision in the consolidated cases of Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., striking down the sweeping global tariffs implemented by the Trump administration. Chief Justice John Roberts authored the majority opinion, which ruled that the International Emergency Economic Powers Act (IEEPA) does not grant the President the authority to unilaterally impose tariffs. The Court emphasized that while IEEPA allows the President to “regulate” commerce during national emergencies, it does not transfer Congress’s exclusive constitutional power to levy taxes and duties to the Executive Branch.

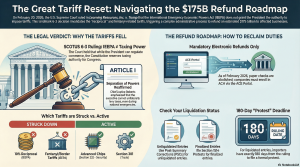

The ruling immediately invalidates the broad “Liberation Day” reciprocal tariffs and the fentanyl-related tariffs targeting China, Canada, and Mexico. This decision triggers a massive administrative undertaking, as an estimated $175 billion to $179 billion in unlawfully collected duties is now subject to potential refunds. Importers face a complex path to reclaim these funds, which heavily depends on whether their customs entries are unliquidated or liquidated. For unliquidated entries, businesses can file Post-Summary Corrections (PSCs) to adjust their duties to zero. For entries that have already been liquidated, importers must proactively file a formal protest within 180 days of liquidation or pursue protective litigation in the Court of International Trade. Furthermore, all refunds will now be processed electronically, requiring businesses to enroll in the Automated Clearing House (ACH) program, as U.S. Customs and Border Protection stopped issuing paper checks on February 6, 2026.

Despite the Supreme Court defeat, the Trump administration has indicated it will not abandon its protectionist trade agenda and is actively pivoting to a “Plan B”. To maintain leverage and protect domestic industries, the White House intends to rely on alternative, legally tested statutes to impose new tariffs. These include Section 232 of the Trade Expansion Act for national security threats (already being used for advanced semiconductors, steel, and aluminum), Section 301 of the Trade Act for unfair trade practices, and potentially Section 122, which allows for temporary 15% tariffs for up to 150 days to address balance-of-payment deficits.

The Rug-Pull Heard ‘Round the World

The ambitious economic architecture of “Liberation Day” met the sharp edge of the Roberts Court’s textualist hammer. In a 6-3 decision that sent immediate shockwaves through global markets, the Supreme Court dismantled a central pillar of the administration’s “America First” strategy, ruling that the executive branch had fundamentally overstepped its constitutional bounds. At stake was a staggering sum: approximately $129 billion already sitting in estimated duty deposits and a total collected and estimated revenue pool nearing $180 billion.The ruling represents more than a fiscal correction; it is a profound “rug-pull” for a trade policy that attempted to reshape global commerce via the stroke of a pen. By invalidating tariffs that were once touted as the primary weapon against trade deficits and fentanyl trafficking, the Court has forced an uncomfortable question to the forefront: How can a central pillar of national economic policy simply evaporate in a single morning? The answer lies in a strict reading of a 1977 statute and a reassertion of the “Major Questions Doctrine” that may permanently alter the executive’s toolkit

The Word That Wasn’t There: A Lesson in Statutory Text

The administration’s legal defense leaned heavily on the International Emergency Economic Powers Act (IEEPA) of 1977, a statute granting the President power to “regulate… importation” during a declared national emergency. However, the Court’s majority found the administration’s interpretation to be “unheralded” and “transformative.” As Chief Justice John Roberts noted, the word “tariff” appears nowhere in the IEEPA text—a glaring omission when compared to other trade statutes like Section 232 or Section 122, which explicitly delegate the power to “adjust” or “tax.”Under the “Major Questions Doctrine,” the Court maintained that if Congress intended to delegate the power to impose “tariffs of unlimited amount, duration, and scope,” it would have done so with unmistakable clarity. Chief Justice Roberts, joined by the Court’s liberal wing and two conservatives, emphasized that the power to “lay and collect Taxes” remains an Article I prerogative of Congress.In a technical but vital distinction, the Court upheld the Federal Circuit’s ruling in V.O.S. Selections while vacating the D.C. District Court’s ruling in Learning Resources for lack of jurisdiction, affirming that the Court of International Trade (CIT) is the exclusive venue for such disputes. The dissenting justices—Thomas, Alito, and Kavanaugh—argued for judicial deference to the President in matters of national security, warning that the Court was treading on the executive’s foreign-affairs domain.As Chief Justice Roberts wrote in the majority opinion:”The president asserts the extraordinary power to unilaterally impose tariffs of unlimited amount, duration and scope… but the government points to no statute where Congress expressly said IEEPA could apply to tariffs.

The Great Refund Scramble and the “Digital Trap

For the thousands of importers now legally entitled to billions in refunds, the judicial victory has collided head-on with a digital-first bureaucracy. In a move to combat fraud, U.S. Customs and Border Protection (CBP) mandated a transition to 100% electronic refunds (ACH) via the ACE Portal on February 6, 2026—just two weeks before the ruling.This has created a “digital trap.” Companies not yet digitally enrolled or those with outdated “Form 5106” identity records are finding their refunds stuck in a federal limbo. The logistics are further complicated by the “314-day rule.” In standard customs practice, entries liquidate automatically after 314 days. For those whose entries have already liquidated, the path to a refund requires a formal Section 1514 Protest within a strict 180-day window. For unliquidated entries, importers must navigate the Post-Summary Correction (PSC) process.The administrative burden is unprecedented. With over 19 million entries remaining unliquidated as of late 2025, the government faces a “fiscal shock” that could delay disbursements for months, if not years, as the Treasury Department warns that a blanket refund of $180 billion—exceeding the annual budget of the Department of Transportation—presents a genuine “fiscal cliff.”

The “Existential Risk” and the Supply Chain Reset

For small businesses and the automotive sector, the ruling is less about a legal theory and more about survival. Lead plaintiff Learning Resources , a family-owned toy manufacturer, faced an “existential risk” after suffering a staggering 44-fold increase in costs. CEO Rick Woldenberg argued that while large corporations could stockpile imports to weather the storm, small firms were left with no capital leeway.The automotive sector is witnessing an immediate “reset button” effect. The American Automotive Policy Council (AAPC) had previously warned that the tariffs were dismantling 40 years of North American supply chain integration. Manufacturers had already begun planning 4% to 10% price hikes to absorb the IEEPA duties. In one notable shift, Honda had even begun moving Civic Hybrid production from Japan to Indiana to avoid the tax—a move that underscores the “tariff-driven” urgency that has now suddenly dissipated. The ruling allows “just-in-time” logistics to resume, saving sectors that were facing a catastrophic fragmentation of their manufacturing models.As Woldenberg described the situation during litigation:”This path is catastrophic… Small businesses were hardest hit by the tariffs; compared to large companies that had sufficient on-hand capital to stock up on imports prior to enforcement… many small businesses had little leeway to prepare.

The Pivot: Why the “Trade War” is Just Changing Shape

Investors hoping for a permanent ceasefire in the trade war will be disappointed; the administration is already moving to “Plan B.” By shifting from the emergency authority of IEEPA to more targeted statutes like Section 232 (National Security) and Section 301 (Unfair Trade Practices), the White House is seeking “judicially harder to challenge” pathways.The administration had already signaled this pivot by exempting the “Greenland 8” allies from IEEPA duties in January 2026, using trade as a geopolitical lever. Now, the Department of Commerce has launched a “hyper-active” series of Section 232 investigations into advanced semiconductors, robotics, critical minerals, and pharmaceuticals.These alternative routes carry higher procedural hurdles. Unlike the IEEPA, which the administration used as a “stroke of the pen” authority, Section 232 requires formal investigations by the Commerce Department. Furthermore, the Court’s ruling highlights the limitations of other tools, such as Section 122 of the Trade Act of 1974, which is strictly capped at a 15% tariff for a maximum of 150 days. The shift marks a transition from broad economic emergencies to a more fragmented, “security-first” trade regime.

A New Balance of Power

The ruling in Learning Resources v. Trump is a watershed moment for the separation of powers. By reasserting the constitutional line between the White House and Congress, the Supreme Court has made it clear that “muscular” trade policy cannot be built on “creative readings” of emergency statutes.However, the administration’s immediate pivot to Section 232 and 301 investigations suggest that the era of aggressive protectionism is not ending—it is simply slowing down. We are entering a period where trade policy will be defined by procedural heavy-lifting and sector-specific investigations rather than overnight executive orders. As the “Great Refund Scramble” begins, the business world must grapple with a new reality: even when the Court strikes down a tax, the administrative and political machinery of a trade war remains very much in motion. The question for 2026 is whether the administration’s “Plan B” is merely a slow-motion version of the same constitutional conflict.