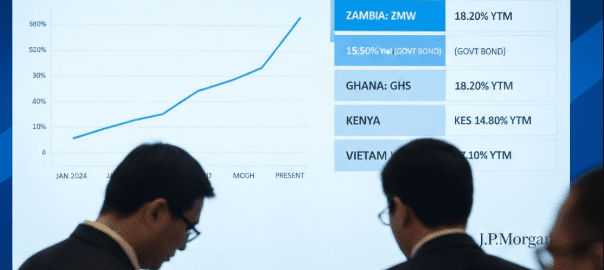

10 Feb. 2026 /Mpelembe Media — New Frontier Benchmark JPMorgan is finalizing plans to launch a new frontier market local currency debt index, aiming to formalize investment in high-yield, developing economies. Expected to include 20 to 25 countries, the index focuses on nations such as Egypt, Vietnam, Kenya, and Nigeria, which are anticipated to carry the heaviest weightings. This launch addresses growing investor appetite for riskier debt, with analysis suggesting that frontier local markets have systematically outperformed mainstream emerging market indices over the last eight years.

Zambia’s Critical Role and “Making the Cut” Zambia has emerged as a focal point in the index’s creation. While investors are eager to include Zambian debt due to its high return potential, the country initially faced exclusion due to the index’s strict liquidity requirement, which demands individual bonds satisfy a minimum size of $250 million. Historically, Zambia issued smaller local bonds, but following pressure from money managers who explicitly told JPMorgan they “would like to see [Zambia] included,” the country has issued at least one larger bond to meet the threshold. This move effectively clears the path for Zambia to join the benchmark, validating investor confidence in its post-restructuring recovery.

Context of Recovery The push for Zambia’s inclusion follows its landmark debt restructuring completed in 2024, which ended a prolonged default and set a precedent for the G20 Common Framework. Following this restructuring, Zambia’s sovereign bonds were quickly re-added to JPMorgan’s wider Emerging Market Bond Indexes (EMBI), signaling a restoration of market normalcy that has fueled the current demand for its local currency debt.

Index Criteria & Impact

Eligibility: Bonds must have over 2.5 years remaining maturity and meet the $250 million size minimum.

Weighting Caps: Individual countries will likely be capped at 8% to 10% to prevent larger economies like Nigeria or Egypt from dominating the index.

Strategic Goal: The index aims to reduce reliance on “hard currency” (dollar) debt, encouraging frontier nations to develop their domestic capital markets to buffer against foreign exchange shocks.

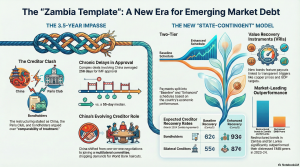

Based on the provided sources, Zambia’s debt restructuring influenced its inclusion in JPMorgan’s indices in two distinct ways: it directly restored eligibility for the hard-currency EMBI index and created the market stability necessary to meet the liquidity thresholds for the new Frontier Local Currency index.

Based on the restructuring deal, Zambia will be forced to pay bondholders approximately $1 billion more (in net present value terms) if its economy performs better than expected between 2026 and 2028.

This additional payment is activated if either one of the following two specific “triggers” is met:

Improved Credit Rating (Debt Carrying Capacity): If the IMF and World Bank upgrade Zambia’s official debt-carrying capacity from “weak” to “medium” for two consecutive semi-annual reviews.

Stronger Economic Performance: If the three-year rolling average of both exports (goods and services) and government revenues (measured in US dollars) exceeds the IMF’s December 2023 projections.

What happens if a trigger is pulled? If either condition is met, the terms of Bond B (the “state-contingent” bond) change drastically to favor investors:

Faster Repayment: The maturity date accelerates by nearly 20 years, meaning the bond must be fully repaid by 2035 instead of 2053.

Higher Interest: The interest rate jumps from a concessional 0.5% to a market rate of up to 7.5% (matching Bond A).

Financial Impact: These changes would increase the net present value of the debt by roughly 51%, effectively reducing the debt relief Zambia receives from 44% to just 15%.

Based on the sources, the “triggers” embedded in Zambia’s restructuring deal act as a double-edged sword for the country’s future debt sustainability. They are designed to match repayment obligations to Zambia’s economic health, but they introduce the risk of significantly reducing the debt relief the country receives if its economy performs better than expected.

Here is how these triggers affect debt sustainability:

1. Reduction of Debt Relief The most direct impact of the triggers is a potential drastic reduction in the amount of debt forgiveness Zambia receives.

Massive Cost Increase: If the triggers are activated, the financial terms of Bond B become much more expensive. The interest rate jumps from a concessional 0.5% to a market rate of 7.5% (matching Bond A), and the repayment period is shortened by nearly 20 years (maturing in 2035 instead of 2053).

Shrinking Relief: Analysis by Debt Justice indicates that triggering these terms would increase the net present value (NPV) of the payments to bondholders by approximately $1 billion. This effectively reduces the debt relief Zambia receives from 44% down to just 15%.

2. Alignment with “Ability to Pay” The strategic logic of the triggers is to ensure sustainability by linking payments to economic capacity. The triggers only activate under two specific “upside” conditions between 2026 and 2028:

Improved Credit Rating: If the IMF/World Bank upgrade Zambia’s official debt-carrying capacity from “weak” to “medium” for two consecutive reviews.

Economic Outperformance: If exports and tax revenues exceed the IMF’s December 2023 projections on a three-year rolling average.

** sustainability Rationale:** This structure theoretically protects sustainability by keeping payments low (the “Base Case”) if the economy remains fragile, while allowing creditors to recoup losses only if Zambia’s economy becomes robust enough to handle higher debt servicing.

3. Inter-Creditor Equity Risks The triggers create a disparity between private bondholders and official government lenders, which could complicate future sustainability discussions.

Higher Recovery for Private Lenders: Under the “upside” (triggered) scenario, bondholders are projected to recover 93 cents on the dollar, compared to 87 cents for official bilateral creditors (like China and the Paris Club).

Future Friction: If Zambia hits these triggers, it will be paying private investors significantly more than the foreign governments that provided the initial political backing for the restructuring. This divergence was a major sticking point during negotiations, with official creditors initially rejecting the deal because they felt it treated private bondholders too favorably.

4. Vulnerability to Volatility While the triggers are meant to activate only during economic recovery, they rely heavily on metrics like export revenues, which in Zambia are tied closely to copper prices. A temporary boom in copper prices could potentially pull the trigger, locking Zambia into higher, accelerated repayments (Bond B maturity moving to 2035) that it must sustain even if copper prices subsequently crash.

Based on the provided sources, if copper prices crash after a trigger event has occurred, Zambia would still be obligated to pay the higher, accelerated debt service costs. The restructuring agreement does not include a mechanism to revert to lower payments if the economy subsequently deteriorates.

Here is the detailed breakdown of the situation:

The Trigger is Irreversible: The restructuring terms for “Bond B” specify that once the trigger conditions are met (driven by high copper prices increasing exports and revenue), the interest rate increases and the maturity date accelerates “from the trigger date until maturity”. It is a one-way switch; there is no provision to lower the interest rate back to 0.5% or extend the maturity back to 2053 if copper prices fall.

The “Volatility Trap”: This creates a significant risk for future debt sustainability. Observers have noted that while the deal provides relief now, it offers “no mechanism for containing debt payments if Zambia is hit by further shocks” after a trigger event.

Financial Impact: Consequently, if copper prices spike temporarily (triggering the upgrade) and then crash, Zambia would be locked into a “worst-of-both-worlds” scenario:

Low Revenue: The government would have reduced income due to the crashed copper prices.

High Debt Costs: It would simultaneously face the “Upside Case” repayment schedule, which requires paying a 7.5% interest rate (up from 0.5%) and repaying the principal by 2035 (instead of 2053).

This structure leaves Zambia vulnerable to the inherent volatility of the copper market, potentially forcing the country to service expensive commercial-rate debt during a period of economic downturn.