Feb 11, 2026 /Mpelembe media/ — Ownership and Reputation Crisis Manchester United is navigating a period of significant off-pitch turbulence following controversial comments made by co-owner Sir Jim Ratcliffe regarding immigration in the UK. His remarks sparked a fierce backlash from fan groups—including the Manchester United Muslim Supporters Club and the Stretford Sikhs—and drew condemnation from local politicians like Mayor Andy Burnham. The club took the unusual step of releasing a statement to distance itself from Ratcliffe’s views, emphasizing its commitment to the “All Red All Equal” campaign and reaffirming Manchester as an inclusive city. While Ratcliffe issued an apology, critics viewed it as half-hearted.

On-Pitch Changes and Transfer Speculation (2026 Context) The sources indicate a future scenario (dated February 2026) where:

- Managerial Shift: Ruben Amorim has been sacked after 14 months, and former player Michael Carrick has been appointed as interim manager.

- Player Movements: Speculation surrounds a potential return for Marcus Rashford, currently on loan at Barcelona. Former coach Rene Meulensteen believes Carrick’s appointment could facilitate Rashford’s comeback. Meanwhile, the squad is contending with a lack of January signings and a fight for Champions League qualification.

- Women’s Team Success: The women’s team, led by Marc Skinner, recently secured a commanding 3-0 victory over Atletico Madrid in the Champions League, highlighting a ruthless attacking performance.

Infrastructure and Future Vision Despite the controversies, the club is pushing forward with ambitious infrastructure plans:

- “New Trafford”: A joint task force involving Lord Coe and Mayor Andy Burnham has launched the Old Trafford Regeneration Mayoral Development Corporation. The goal is to build a new 100,000-capacity stadium to serve as a catalyst for the region’s economy and potentially host the 2035 FIFA Women’s World Cup.

- Financials: The club reported record revenues of £666.5 million for the year ending June 2025, though it still recorded a net loss of £33 million.

Fan Relations The Manchester United Supporters Trust (MUST) continues to advocate for supporter ownership and better deals for match-going fans, maintaining a dialogue with the club despite the complex ownership structure involving the Glazers and INEOS. The club has also recently launched official Jewish and Sikh supporters’ clubs to foster inclusivity.

1. The Hook: A Brand at a Crossroads

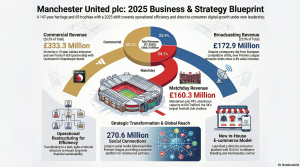

Manchester United remains the ultimate contradiction in global sports. According to its latest SEC disclosures, the club achieved a record annual revenue of £666.5 million, yet this financial titan is anchored by a staggering £637 million in total indebtedness. This commercial juggernaut recently endured its most turbulent “fever dream,” plummeting to a 15th-place league finish despite the brand’s gravitational pull for tier-one partners like Snapdragon and Tezos.This deep dive uncovers the startling reality of a club navigating a radical executive restructuring while its 147-year heritage faces its most fragile period. As new leadership attempts to build a “lean and agile” corporate structure, the disconnect between the balance sheet and the league table has never been more pronounced. We explore the surprising disclosures from the latest 20-F filings and supporter manifestos that signal a fundamental shift in the club’s governance.

2. The “Champions League Tax”: The High Cost of Performance

For Manchester United, the failure to qualify for elite European competition has shifted from a sporting disappointment to a definitive line item for the accounting department. The club’s men’s first-team performance during the 2024/25 season has officially triggered a penalty clause in the lucrative adidas contract extension. Consequently, a £10 million annual deduction from the minimum guarantee will be applied starting in the 2025/26 season.This “Champions League Tax” underscores how on-field failure now carries a direct, quantifiable price tag that complicates the club’s financial sustainability. By codifying sporting success into commercial contracts, the board has turned the manager’s tactical decisions into high-stakes corporate risks.”The extended contract includes a clause stating that a £10 million deduction will be applied for each year of non-participation in the UEFA Champions League, commencing from the 2025/26 season.”

3. The E-commerce Pivot: Trading Control for Growth

To mitigate a 22% collapse in broadcasting revenue—which fell from £221.7 million to £172.9 million following the drop to the Europa League—United has executed a defensive e-commerce maneuver. The October 2024 launch of the SCAYLE platform represents a pivot toward an in-house, direct-to-consumer model. This shift helped drive a 15.8% increase in Retail, Merchandising, and Apparel revenue, which reached £144.9 million.Owning the data and the digital touchpoint is becoming as vital to the club’s survival as the football itself. By controlling the merchandise engine, the club can somewhat insulate itself from the volatility of match results. However, the reliance on selling “lifestyle” to a global audience creates a precarious tension when the core product on the pitch continues to underperform.

4. The 10-to-1 Voting Wall: The Reality of Fan Ownership

The Manchester United Supporters Trust (MUST) has successfully grown its “Withdrawable Share Capital” (WSC) fund to £2.5 million, yet meaningful ownership remains a distant mirage. The club’s “Class B” share structure acts as a financial fortress, with 116,348,173 Class B shares held by the ownership, each carrying 10 times the voting rights of the 56,080,686 public Class A shares. This ensures the Glazer family maintains a 67.91% voting interest, effectively neutralizing any minority fan influence.MUST admits that establishing a meaningful stake is “largely outside of our control at this time” due to this weighted system. While fans contribute to the WSC, the structural reality of the New York Stock Exchange listing ensures that the boardroom remains insulated from the terraces.”Regrettably the current share structure that the Glazers have set up (whereby their shares hold 10 times the voting rights… provides no immediate prospect of establishing our aspirations of a meaningful stake in the Club.”

5. The Rise of the Independent Regulator

The era of football “self-regulation” reached a definitive end in July 2025, when the Football Governance Bill received Royal Assent. This landmark legislation introduces an Independent Regulator with the power to oversee the top five tiers of English football, representing a point of no return for corporate governance in the Premier League.The new body holds significant powers to intervene in Manchester United’s operations:

- Strengthening governance and financial resilience: Mandating sustainable business models to protect club longevity.

- Overseeing fan-club relationships: Formalizing “structured dialogue” to ensure supporter voices are legally recognized.

- New cost controls: Implementing revised “owners and directors” tests to monitor significant shareholders.

6. The “Carrick Impact” vs. Long-Term Strategy

The club recently navigated a “fever dream” scenario where Michael Carrick stepped in as an interim figure following the departure of a Portuguese leader. Carrick secured immediate, high-profile victories against Manchester City, Arsenal, Fulham, and Tottenham, providing a “legendary figure” bounce that momentarily masked deep structural flaws. However, the club’s new hierarchy is betting on a systemic, “lean and agile” corporate approach rather than temporary emotional lifts.The irony of the cycle is palpable: after the interim success of an old hero, the club has turned back to another Portuguese leader in Head Coach Ruben Amorim. Combined with the appointments of Omar Berrada (CEO) and Jason Wilcox (Football Director), the board is attempting to harmonize a cold, corporate-led strategy with the romanticism of the club’s heritage.

7. Conclusion: The Price of a Soul

The latest financial records illustrate a club that is a commercial masterpiece but a sporting enigma, operating at 99% capacity at Old Trafford and generating £160.3 million in matchday revenue. Yet, the £637 million debt and the looming £10 million adidas penalty serve as stark reminders that financial titanism cannot forever ignore on-field mediocrity. The disconnection between the boardroom’s e-commerce triumphs and the team’s 15th-place finish suggests that the brand’s immunity to failure is finally thinning.Can a club truly be “financially sustainable” if its identity is increasingly untethered from its sporting results? The 147-year heritage of Manchester United is its ultimate asset, but in an era of 10-to-1 voting walls and government oversight, it is also its most fragile.Closing Statement: Manchester United is a 147-year-old institution currently being tested by the realities of 21st-century corporate governance; its history is its greatest strength, but it cannot be its only defense.

Source Manchester United FC