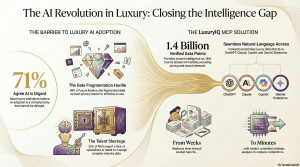

06, Feb. 2026 /Mpelembe Media — Digital Luxury Group (DLG) has announced the launch of LuxuryIQ MCP, the first AI data integration layer specifically designed for the luxury industry. Addressing the “data fragmentation” that 38% of luxury executives cite as a primary barrier to AI adoption, the platform consolidates 1.4 billion proprietary and public data points into a system accessible through natural language conversation.

Key features and context include:

- Unified AI Access: Utilizing the Model Context Protocol (MCP), the platform connects DLG’s databases—covering social media, advertising, search demand, and pricing (including grey market and pre-owned)—directly to major AI tools like ChatGPT, Claude, Copilot, and Gemini Enterprise.

- Speed and Accuracy: By grounding AI responses in verified data rather than “AI guesswork,” LuxuryIQ MCP reduces hallucination risks and condenses strategic analysis that previously took weeks into minutes.

- Market Scope: The system monitors 185 luxury brands across 64 markets, spanning watches, jewelry, fashion, and beauty.

- Availability: Hosted on infrastructure by Ogment, the tool is scheduled to roll out to DLG’s enterprise clients beginning in Q1 2026.

The Luxury Industry’s “Data Paradox”

The luxury sector is currently grappling with a structural “Data Paradox” that legacy Business Intelligence (BI) providers have exacerbated: brands are drowning in a sea of raw data while remaining strategically starved for actionable insights. For years, the industry has operated under the illusion that more data equals better decisions. Instead, it has led to what we now identify as “The Great Grounding”—a necessary, if painful, shift from the era of speculative, hallucination-prone AI content to a new standard of grounded, verified AI context.According to the “State of AI in Luxury” study, which surveyed over 250 luxury executives, 71% acknowledge that AI adoption is an urgent mandate. Yet, despite this consensus, most global houses remain paralyzed by systemic inefficiencies. The launch of DLG’s (Digital Luxury Group) LuxuryIQ MCP marks the end of this paralysis, providing the industry with the specialized, context-aware intelligence layer it has lacked for decades.

The $38 Billion Blind Spot: Why Generic BI is Toxic to Luxury Margins

It is a damning indictment of the $38 billion Business Intelligence industry that its tools remain largely useless for the high-end sector. Generic BI software is built for mass-market volume and linear supply chains; it is fundamentally incapable of capturing the “bespoke” nuances of luxury.Data fragmentation remains the primary hurdle, cited by 38% of luxury executives. Legacy tools fail because they ignore the non-linear realities of the luxury ecosystem: the volatility of the “grey market,” the shifting valuations of the pre-owned (secondary) market, and the critical importance of rarity over volume. While generalist tools track “units sold,” a strategic luxury analyst needs to track brand sentiment, search demand, and pricing velocity across 64 distinct markets. This requires a specialized architecture that bridges the gap between fragmented global data and high-stakes executive decision-making.

Killing the AI Hallucination with “Context”

The greatest threat to AI integration in the boardroom has been the “hallucination”—the tendency of General Purpose LLMs to fabricate strategic insights when they lack specific domain data. To solve this, DLG has implemented the Model Context Protocol (MCP) as a definitive “hallucination killer.”By hosting LuxuryIQ MCP on advanced Ogment infrastructure, DLG allows AI tools like ChatGPT, Claude, and Gemini Enterprise to plug directly into 1.4 billion proprietary data points. This isn’t just a database; it is two decades of luxury expertise distilled into a secure integration layer.”2026 is the year context finally replaced content.”This shift is pivotal. In 2024 and 2025, the industry focused on “content”—using AI to write copy or generate images. In 2026, the focus has moved to “context,” where the protocol ensures that every AI-generated recommendation is anchored in verified market intelligence across watches, jewellery, fashion, and beauty.

The Radical Collapse of Time: From Weeks to Minutes

In the traditional consulting model, a comprehensive competitive analysis across 185+ brands would take weeks of manual data harvesting and analyst synthesis. For the 80+ enterprise clients served by DLG’s offices in Geneva, Shanghai, and New York, that timeline has been rendered obsolete.The LuxuryIQ MCP utilizes a natural-language interface to compress the research cycle from weeks to minutes. As Pablo Mauron, Managing Partner at DLG, notes: “Luxury brands that move first on AI-powered intelligence will outpace competitors still waiting days for analyst reports.” This radical collapse of time transforms market intelligence from a static post-mortem into a real-time competitive weapon. In a market where trends in Shanghai can shift overnight, waiting for a week-old report is a recipe for irrelevance.

Bridging the “Talent Gap” Through Conversation

The human element remains the final barrier to digital transformation. 32% of luxury executives cite a lack of AI-specific talent as a reason for their stagnation. Historically, accessing deep-tier data required a specialized team of data scientists and analysts to act as intermediaries.LuxuryIQ MCP democratizes this intelligence by making conversation the primary interface. By allowing executives to query complex advertising activity, social performance, and retail pricing through simple natural language, the “talent gap” is effectively bridged. You no longer need a PhD in data science to understand global search demand; you simply need to ask the right question. This empowers decision-makers at every level to act on insights that were previously locked behind technical silos.

Conclusion: The Birth of the “Agentic Financial Layer”

As we approach the Q1 2026 rollout of LuxuryIQ MCP, we are witnessing the birth of the “Agentic Financial Layer.” This represents the next evolution of luxury business: a world where AI agents act autonomously on high-fidelity market data to optimize pricing, advertising, and retail strategies.The industry is moving past the era of fragmented data and into a period of integrated intelligence. The technical barriers to data retrieval have effectively vanished. As the playing field levels, the competitive advantage will no longer reside in who has the data, but in who has the vision to use it.In a world where every brand has the same data, will the ultimate luxury be the human intuition used to act on it?