10 Feb. 2026 /Mpelembe Media — Ripple will unveil its 2026 Roadmap on February 11, focusing on integrating XRP into capital markets. Key updates include smart contracts, zero-knowledge proofs for privacy, and cross-chain liquidity. These advancements aim to drive institutional adoption and utility.

By 2026, the convergence of Artificial Intelligence (AI) and blockchain technology is creating a new layer of digital commerce defined by autonomous agents. These agents are no longer just passive tools but active economic participants capable of transacting, verifying, and coordinating activity without human intervention.

The “Invisible” Economy: The breakout consumer applications of 2026 are expected to feel like modern fintech rather than “crypto.” AI agents will operate quietly in the background, utilizing stablecoin settlement rails and provenance protocols to manage transactions and digital assets automatically.

Agent-to-Agent Commerce: Venture capital is heavily backing this shift, with startups building protocols specifically for agent-to-agent commerce. Major players like Coinbase and Solana are integrating AI inference directly into crypto wallets, enabling them to self-manage assets.

Solving the Trust Deficit: Blockchain is providing the necessary “trust layer” for AI. Protocols are being deployed to verify the provenance of AI-generated content, helping enterprises and consumers distinguish between authentic media and deepfakes or synthetic content.

DePIN and Compute Power: The demand for AI compute is revitalizing Decentralized Physical Infrastructure Networks (DePIN). Networks are shifting from token incentives to generating actual revenue by providing edge computing and distributed storage for enterprise AI workloads.

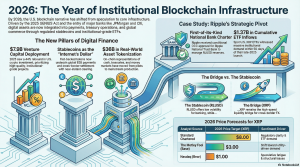

Broader Financial Context This rise of AI agents is occurring alongside a massive maturation of crypto infrastructure. Ripple has pivoted toward becoming a regulated financial cornerstone, securing a national trust bank charter to manage its stablecoin (RLUSD) reserves. Simultaneously, the market is bracing for a wave of crypto IPOs, with companies like Kraken, ConsenSys, and Ripple-affiliated treasuries like Evernorth preparing to go public, signaling that digital assets have moved from speculation to essential financial infrastructure.

For over a decade, blockchain was synonymous with the high-volatility “hype cycle”—a period defined by speculative retail bubbles and tentative corporate pilots. To the sophisticated observer, it was a sector often dismissed as a “wait-and-see” experiment. As we move through 2026, that narrative has reached a structural milestone. The conversation has transitioned from “if” blockchain is viable to “how” its architecture now underpins the global economy.Blockchain is no longer the product; it is the plumbing. We have entered the era of institutional architecture, where the technology is becoming increasingly invisible, even as its impact on settlement speed and transparency becomes unmistakable.

Blockchain Has Reached Its “Invisible Infrastructure” Phase

In 2026, blockchain has successfully transitioned from front-of-house speculation to back-office utility. This shift is enabled by technical maturation, specifically the rise of zero-knowledge Layer 2 solutions like Linea . These networks provide the scalability and privacy required for institutional-grade applications to operate without the friction of early-generation chains.Firms like Chainalysis have cemented their role as the “trust layer,” providing the essential AML and KYC frameworks used by global banks and law enforcement to manage digital assets within a compliant perimeter. Meanwhile, ConsenSys serves as the “engine room,” providing the infrastructure that allows traditional firms to scale decentralized applications. In this phase, blockchain is the quiet powerhouse behind wallets, DeFi platforms, and enterprise systems that function as standard financial infrastructure.

The Stablecoin as the “Internet’s Dollar”

The primary driver of this institutionalization is the stablecoin, specifically USDC and the newly launched RLUSD . Following the passage of the GENIUS Act in July 2025 , which established federal standards for U.S. stablecoins, these assets have become the primary settlement tools for global commerce.A critical strategic distinction has emerged: while XRP remains a speculative asset for some, RLUSD is being positioned as a volatility-free bridge currency, ideal for treasury operations where price stability is non-negotiable.”Compared to ACH or credit card networks, which can take days to clear, stablecoin transactions settle in seconds at materially lower cost.” — Silicon Valley Bank (SVB) Market InsightsBy treating tokenized dollars as 24/7 liquid cash, corporations have integrated these assets directly into cross-border B2B payments, modernizing the financial plumbing that once relied on multi-day settlement cycles.

The Birth of the “Full-Stack” Crypto Bank

Ripple’s transformation illustrates the broader shift toward integrated institutional services. Following its conditional OCC approval in December 2025 to establish the Ripple National Trust Bank , Ripple has transitioned from a payments company into a regulated, “full-stack” financial institution valued at $40 billion .Ripple has executed a clinical acquisition strategy to build this infrastructure, spending over $2.4 billion to acquire prime brokerage Hidden Road ($ 1.25 billion), treasury software provider GTreasury ( $1 billion), stablecoin platform Rail ($ 200 million), and custody solutions developer Palisade . This strategy targets “TradFi-adjacent” firms, effectively bridging the gap between traditional and decentralized finance. CEO Brad Garlinghouse’s offensive against bank lobbyists signals a new reality: compliance and innovation are no longer at odds; they are the prerequisites for the next generation of banking.

AI Agents Are the New Consumers

We are witnessing a profound convergence between Artificial Intelligence and blockchain. In 2026, autonomous agents —AI entities capable of managing assets and executing transactions independently—have emerged as a significant new class of economic actors.The strategic trend line is clear: in 2025, 40 cents of every crypto venture capital dollar went to companies building AI products, a sharp increase from just 18 cents in 2024 . Blockchain serves as the essential solution to AI’s “trust problem.” Through provenance protocols and on-chain verification, blockchain provides the verifiable data and immutable history these agents need to operate, while also offering a mechanism to identify deepfakes and secure digital commerce.

Wall Street is Moving On-Chain (RWAs)

Real-World Asset (RWA) tokenization has graduated from pilot projects to production-scale infrastructure. Wall Street is increasingly using blockchain to fractionalize ownership of stocks, bonds, and real estate, merging private and public markets onto unified settlement networks.Institutional adoption is now measurable in the billions. BlackRock’s BUIDL fund surpassed $500 million in AUM within months of launch, while Franklin Templeton’s tokenized funds have scaled past ****$ 400 million .”In the future, people won’t keep stocks and bonds in one portfolio and crypto in another… Assets of all kinds could one day be bought, sold, and held through a single digital wallet.” — BlackRock ExecutivesThis convergence allows for intraday settlement and reduced administrative overhead, effectively making the underlying blockchain infrastructure an invisible layer of the global capital markets.

The “Mobile-First” Blockchain Leap

To bridge the gap between technical infrastructure and mainstream usability, blockchain is moving into hardware. Solana Labs has led this transition with the Seeker smartphone , which embeds blockchain capabilities directly into consumer electronics. By removing the technical friction of seed phrases and manual wallet management, these “mobile-first” devices allow Web3 functionality to feel as intuitive as a standard mobile application, further obscuring the “crypto” layer from the end-user.

Closing: The Strategic Waiting Game

Despite these structural gains, the industry is currently engaged in a Strategic Waiting Game . While the GENIUS Act provided the necessary federal standards in 2025, the law does not take full effect until January 2027 . This regulatory gap, combined with the uncertainty surrounding the 2026 U.S. Midterm Elections , has led major players like Ripple to defer immediate IPO plans.Bolstered by a $500 million strategic raise , Ripple and its peers can afford to remain private, timing their public debuts for a post-election environment where the regulatory seas have fully settled. The infrastructure for the next century of finance is already built; the industry is simply waiting for the final legal hurdles to clear before the transition becomes permanent.The strategic question for every financial leader today is no longer about the viability of the technology, but about readiness. Are you prepared for a financial system where the “crypto” part is entirely invisible, but the speed and transparency are unmistakable?