The Billion-Dollar Handshake: Why the World’s Diamond Giants are Finally Teaming Up

10 Feb. 2026 /Mpelembe Media — The 2026 Investing in African Mining Indaba is currently underway in Cape Town, South Africa, operating under the theme “Stronger Together: Progress Through Partnerships”. The event has attracted record attendance, including 58 government ministers and two heads of state, amidst an intensifying geopolitical race for critical minerals.

The conference has been defined by three major developments: aggressive US-led initiatives to secure supply chains outside of China, significant regulatory reforms in South Africa to stimulate exploration, and a concerted push to integrate community voices and junior miners into the core value chain.

Key Developments

1. Geopolitics: Project Vault and “FORGE” A dominant narrative at the Indaba is the US government’s strategic pivot to secure critical minerals. US President Donald Trump officially launched “Project Vault,” a $12 billion initiative ($10 billion in EXIM Bank loans and $1.67 billion in private capital) to create a domestic strategic stockpile of minerals.

- The Ivanhoe Deal: In conjunction with this, Ivanhoe Mines is in advanced discussions with DRC state miner Gécamines and trader Mercuria to supply zinc concentrate—rich in gallium and germanium—from the Kipushi mine directly to the US market.

- New Alliances: The US also convened a “Critical Minerals Ministerial” to launch the Forum on Resource Geostrategic Engagement (FORGE), a coalition including the G7, India, and others, aimed at creating supply chains independent of China.

2. South African Regulatory Reform South Africa used the platform to announce a “comprehensive reset” of its mining policy to revive exploration. Mineral and Petroleum Resources Minister Gwede Mantashe announced the removal of Black Economic Empowerment (BEE) requirements at the prospecting stage, a move designed to lower barriers for high-risk exploration.

- Infrastructure: The country continues to push its Critical Minerals Strategy, moving from a “pit-to-port” model to industrialization and beneficiation at the source.

- Exploration Fund: Commitments to the Junior Mining Exploration Fund have grown to over R2 billion.

3. Community and Industry Shifts The event emphasized that the future of mining relies on social license.

- Community Voices: The “Community Voices” competition doubled its winners to ten, elevating grassroots leaders to the main stage to discuss shared accountability and economic realism alongside CEOs.

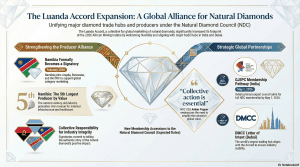

- Diamonds: The Luanda Accord, which promotes natural diamonds, expanded as Namibia formally joined as a signatory. India’s GJEPC and the Dubai Multi Commodities Centre (DMCC) also signed MoUs to become members of the Natural Diamond Council.

- Junior Mining: The “Dealmakers Den” pitch competition highlighted emerging projects, with Midnight Sun Mining (Critical Minerals) and Pasofino Gold (Gold) named as previous winners.

4. Technology and Trends The event showcased how the “data layer” is becoming an economic variable in mining, with AI and data governance being critical for securing financing and verifying supply chains for Western markets. Key trends identified for 2026 include the widening supply gap for copper, central bank accumulation of gold, and the diversification of battery metal refining outside of China.

The Hook: A Quiet Revolution in Cape Town

On February 9, 2026, the corridors of the African Mining Indaba in Cape Town witnessed a departure from a century of industrial dogma. Historically, the diamond sector has been a theater of fierce rivalry and guarded secrets, yet the second high-level meeting of the Luanda Accord signaled a seismic shift toward an integrated defensive alignment. We are witnessing the end of the “solitary miner” era, replaced by a sophisticated consolidation of sovereign interests.The movement, which germinated in mid-2025, has transitioned from a mere policy framework into a formidable engine of collective action. This is not a simple marketing exercise; it is a fundamental pivot by the world’s most significant producers and trade hubs to secure the Natural Diamond Council (NDC) as the industry’s primary execution arm. The urgency is palpable as stakeholders race to sign a unified mandate for multi-billion-dollar investments in global generic marketing.This transition represents more than a strategic tweak—it is a psychological overhaul. The industry is moving decisively away from the defensive posture of the “Blood Diamond” era toward a proactive “Development Diamond” narrative. By centering the diamond as a tool for national building, the Accord seeks to insulate the natural stone from the commoditization pressures of the broader luxury market.

Namibia: The Fifth Giant Enters the Fold

The formalization of the Government of the Republic of Namibia as a signatory to the Luanda Accord is a strategic masterstroke. As the world’s fifth-largest producer by value, Namibia’s entry completes a “Power Four” alliance alongside Angola, Botswana, and the Democratic Republic of Congo. This bloc now controls the overwhelming majority of the planet’s natural diamond supply by value, effectively creating a “Diamond OPEC” with the leverage to dictate the category’s future.Namibia’s involvement brings a unique dimension of technical sophistication to the alliance. While other nations rely on traditional open-pit mining, Namibia is a pioneer in marine-based production, a high-tech feat that underscores the extreme rarity and geological complexity of the natural resource. Having utilized diamond revenue as a cornerstone of its economy since 1908, Namibia’s commitment is a bet on the enduring value of the “luxury of the earth.”“Natural diamonds have helped shape Namibia’s economic story for more than a century, creating jobs, supporting communities and contributing directly to national development. By joining the Luanda Accord, Namibia is affirming that producing countries have both a stake and a responsibility in telling the true story of natural diamonds. This is about ensuring that the value created by our resources continues to benefit our people, today and for generations to come.” — Honourable Modestus Amutse, Minister of Industries, Mines and Energy of the Republic of Namibia

The “Engine Room” Joins the Board: India’s Strategic Shift

The Gem & Jewellery Export Promotion Council (GJEPC) moving toward full Natural Diamond Council membership marks the moment the “engine room” of the industry joined the board of directors. India sits at the absolute heart of the value chain, where the vast majority of the world’s stones are cut and polished.For India, this shift is a survival tactic rather than a mere branding choice. As the manufacturing hub, India is uniquely vulnerable to the pricing volatility and ethical ambiguities of Lab-Grown Diamonds (LGDs). By paying into the miners’ marketing fund, the GJEPC is making a strategic bet on long-term price stability. They are essentially investing in a “defensive shield” to ensure that the cutting and polishing sector remains tethered to a high-value, authentic product rather than an industrial factory output.The May 1st Deadline The GJEPC has set a firm deadline of May 1, 2026, to finalize its membership and financial contributions. This timeline is calculated to ensure a fully integrated global offensive is operational in time for the 2026 holiday season—the industry’s ultimate litmus test for consumer sentiment.

Dubai’s Declaration: From Trading Hub to Category Guardian

Dubai’s role in this alliance provides the necessary logistical and financial bridge between the mines of Africa and the markets of the East. The Dubai Multi Commodities Centre’s (DMCC) Letter of Intent to join the NDC signifies a transition from a neutral trading floor to a vocal category guardian.The “Dubai-Africa pipeline” is critical to this new world order. By providing African producing nations with a high-transparency gateway, Dubai allows these sovereigns to bypass traditional Western gatekeepers and connect directly with emerging wealth in India, China, and the GCC. This bypass creates a more transparent, future-focused sector where the commercial middle-market is just as invested in the “authenticity narrative” as the miners themselves.“Strengthening the way natural diamonds are presented to consumers is key to building awareness and sustaining demand. We also recognise the important role African producing nations play in the industry and will continue to work with partners to help ensure the value generated supports economic progress in the countries and communities from which these resources originate. By connecting production with international markets through Dubai, DMCC will continue to support a transparent, competitive and future focused diamond sector.” — Ahmed Bin Sulayem, Executive Chairman and CEO of DMCC

More Than Just Sparkle: Diamonds as National Infrastructure

The Luanda Accord is predicated on a cold reality: for nations like Namibia, diamonds are national infrastructure. While lab-grown diamonds are industrial factory products designed for efficiency and margin, natural diamonds fund the sovereign stability of entire nations.In Namibia, diamond revenue is the lifeblood of the national budget, specifically funding:

- Healthcare: Sustaining regional hospitals and a robust public health system.

- Education: Funding the schools and vocational training that prepare the next generation.

- Infrastructure: Developing the road networks and utilities essential for remote community connectivity.Generic marketing is no longer just about the aesthetic of jewelry; it is a mechanism to protect the “positive impact” of the trade. The Luanda Accord frames the purchase of a natural diamond as an ethical contribution to the national development of sovereign states—a narrative that a factory-grown stone, regardless of its molecular structure, simply cannot replicate.

A New Era of Authenticity

The Luanda Accord’s mission to safeguard the “integrity and desirability” of natural diamonds has moved the industry into a phase of unprecedented global cooperation. By uniting African production power, Indian manufacturing hegemony, and Dubai’s trading infrastructure, the sector is finally speaking with a single, authoritative voice.This is the ultimate battle between the “luxury of the earth” and the “efficiency of the factory.” As the industry unites to tell a story of national building and authenticity, the question for the modern consumer remains: will they prioritize a “true story” of the earth’s finite resources, or the allure of a synthetic replication?As the industry unites to tell a story of national building and authenticity, will consumers prioritize the ‘true story’ of the earth’s resources over the allure of the lab?

Source

youtube.com/@mpelembe