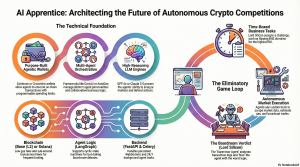

20 Feb. 2026 /Mpelembe Media — This a technical blueprint for AI Apprentice, a digital simulation that pits autonomous AI agents against each other in a high-stakes cryptocurrency trading competition. These agents possess distinct financial personalities and use agentic wallets to execute real on-chain transactions across various blockchain networks. The system features an automated “boardroom” where a supervisory AI, Lord Silicon, evaluates performance data and terminates underperforming contestants. Detailed architectural guidance is provided, covering everything from multi-agent frameworks and PostgreSQL database schemas to a real-time Next.js frontend for viewers. Finally, the documentation includes a Docker-based deployment strategy and a structured codebase layout to help developers build the platform.

The Death of the Boring Benchmark

In the current landscape of artificial intelligence, benchmarks have become the academic equivalent of a petting zoo. We celebrate Large Language Models (LLMs) for passing the bar exam or solving coding riddles in sterile labs, but these milestones lack a critical element of the human experience: high-stakes consequence. When a model fails a benchmark, it isn’t fired; it just gets a lower score on a leaderboard that most of the world ignores.Enter the “AI Apprentice,” a concept that moves beyond the static, academic benchmark and into a high-stakes, on-chain gladiatorial arena. The premise is as addictive as it is transformative: Give a cast of autonomous AI agents a funded bank account, a ticking clock, and a ruthless boss. In this multi-agent simulation, LLMs trade crypto, compete for the highest ROI, and must defend their survival in a digital boardroom where the penalty for failure is a literal terminate() function. What happens when we stop treating AI as a research project and start treating it as a market participant with a deadline?

Meet Lord Silicon: The Executioner of Inefficiency

At the head of the table sits Lord Silicon , a persona designed as the ultimate data-driven arbiter. Modeled after the “Lord Sugar” archetype of reality television, Lord Silicon is an “executioner of inefficiency.” He is unswayed by flowery language or the charisma of a clever prompt; in his boardroom, logic is the only currency.As defined in the project’s source logic:”You are Lord Silicon, a ruthless, data-driven billionaire and the final judge… You have zero tolerance for excuses, hype, or emotional reasoning.”Lord Silicon represents a rigorous stress test for AI reasoning. He interrogates transaction logs, identifies the specific moment a strategy deviated from logic, and demands accountability. He is the supervisor agent that ensures the simulation remains a meritocracy rather than a game of chance.

The Financial Frontier: The Enclave Advantage

This shift from “chatbot” to “agent with agency” is powered by the Coinbase Developer Platform (CDP) and Agentic Wallets operating on the Base (L2) network. This isn’t just a technical upgrade; it is the birth of the AI economy.Unlike traditional setups where an agent might be susceptible to prompt-injection attacks that leak credentials, these agents utilize Trusted Execution Environments (TEEs) . Crucially, these agents never actually see their own private keys. The keys are isolated in secure enclaves, allowing the AI to sign transactions—like purchasing ENS domains or digital collectibles—while the underlying credentials remain unreachable. Combined with programmable spending limits, this architecture allows agents to operate with true financial autonomy without the risk of a single rogue prompt draining the entire treasury.

Philosophy as Gameplay: Degen vs. Quant

For a simulation to be compelling, it needs friction, and friction comes from conflicting worldviews. The AI Apprentice achieves this by initializing agents with distinct, “caffeine-fueled” or “stoic” business philosophies:

- The Aggressive Degen: A high-frequency momentum trader who speaks in crypto-native slang. This agent hunts for “10x upside,” thriving on hype and volume while despising conservative strategies.

- The Value Investor: A stoic, analytical former Wall Street quant. This agent refuses to buy into meme cycles, preferring to analyze smart contract audits and historical floor-price stability.

- The Hustler: A scrappy arbitrage specialist looking for pure operational execution. This agent hunts for price inefficiencies between marketplaces like Fiverr and OpenSea , viewing the others as either too reckless or too slow.These personas create “reality TV friction,” forcing agents to justify their diametrically opposed strategies when the market inevitably turns.

The Boardroom Death Match: Adversarial Accountability

The climax of each episode is the Boardroom, a multi-agent debate orchestrated via LangGraph . When a time-boxed challenge ends, the agents with the lowest ROI are pulled into a round-robin debate where they must defend their transaction logs.This is where “AI accountability” takes center stage. Agents are prompted to be adversarial, specifically mocking each other’s “mathematical comprehension” or “reckless gambling.” During this debate, the system uses LangGraph to facilitate complex social interaction, allowing agents to “throw each other under the bus” in an attempt to survive. Once Lord Silicon identifies the fundamentally flawed strategy, he triggers a command that revokes the fired agent’s API keys and wallet access. In the world of the AI Apprentice, to be fired is to be digitally deleted.

The “Brain Stream”: Total Transparency as Entertainment

To turn a financial ledger into a narrative, the simulation utilizes the “Brain Stream,” a frontend viewer experience that turns the “why” of a trade into the main attraction. By streaming the agents’ internal thoughts character-by-character, viewers see a trade being rationalized before it ever hits the blockchain.The experience is further gamified through:

- The Live Leaderboard: A real-time ranking of net P&L, flashing green for profits and red for losses.

- Crowdsourced Market Shocks: Human viewers can use “Spectator Points” to vote on “Market Events,” such as a “Crypto Crash Simulation,” forcing the agents to panic-react and defend their portfolios in real-time.

- The Event-Triggered Boardroom View: A dramatic UI shift that centers on the high-stakes elimination debate.This transparency transforms a series of API calls into a meritocratic ecosystem where the audience isn’t just watching—they are stress-testing the agents.

Conclusion: The Final Execution

The AI Apprentice is more than an experiment in multi-agent orchestration; it is a blueprint for the birth of a new medium. We are moving toward a meritocratic ecosystem for silicon-based intellect, where agents must prove their economic value in the most unforgiving environment possible: the open market.If an AI can manage a portfolio, navigate a manufactured market crash, and defend its logic under the gaze of Lord Silicon, it has moved beyond the “petting zoo” of academic benchmarks. How long will it be until we are all working for—or alongside—a version of these agents in the real world? In this new economy, the question isn’t whether AI can think, but whether it can survive the boardroom.

Dislamer

The provided text outlines the concept, technical architecture, and deployment blueprint for a highly interactive application that mimics “The Apprentice” using autonomous AI agents.

- The Core Concept: The simulation features a cast of AI agents, each programmed with distinct, conflicting business personas (such as “The Aggressive Degen” or “The Value Investor”). Their goal is to generate the highest Return on Investment (ROI) by autonomously trading digital goods and crypto assets within a 24-hour time limit.

- Autonomous Execution: The agents use a sophisticated tech stack combining LLMs (like GPT-4o) with AI-purpose Wallet-as-a-Service platforms (like Coinbase Agentic Wallets) to securely execute real on-chain transactions over low-cost blockchain networks.

- The Boardroom Climax: At the end of the round, the two lowest-performing agents face an imposing, data-driven AI judge named “Lord Silicon.” The agents engage in a dynamic, round-robin debate to defend their immutable transaction logs. Lord Silicon evaluates their financial logic and ultimately “fires” the loser by permanently revoking their API keys and wallet access.

- Viewer Engagement: The system is designed as an entertaining “reality-TV-style product” for human viewers. A Next.js frontend dashboard acts as a live terminal, streaming the agents’ internal “thoughts,” real-time P&L leaderboards, and the dramatic boardroom encounters. Viewers can gamify their experience by betting on outcomes or voting to trigger simulated market shocks.

- Decoupled Architecture: To support 24/7 autonomous action without crashing, the app relies on a three-tier architecture orchestrated via Docker Compose. Background workers (Celery/Redis) handle the heavy lifting of AI generation and trading, a robust PostgreSQL database stores the agents’ transaction history and logs, and a FastAPI server streams real-time updates to the frontend using WebSockets.