The End of the AI Experiment: 5 Seismic Shifts Redefining the Enterprise

Feb 22, 2026 /Mpelembe media/ — This report outlines a massive shift toward Vertical AI, where specialized models and agents are tailored to the unique workflows and regulations of specific industries like healthcare, finance, and legal services. Unlike general-purpose systems, these tools leverage deep domain expertise to solve niche challenges, driving significant improvements in productivity and operational margins. Market data indicates a surge in venture capital investment, with AI expected to maintain an aggressive annual growth rate through 2030. Key trends highlight the transition from simple assistants to agentic AI, which can autonomously execute complex, multi-step tasks across fragmented data systems. However, organizations still face hurdles, including technical skill shortages, data privacy concerns, and the necessity of redesigning traditional business processes to be “AI-ready.” Ultimately, the landscape is evolving into a specialized ecosystem where industry-specific integration provides a more durable competitive advantage than broad, horizontal applications.

Agentic ecosystems will fundamentally transform enterprise software from standalone tools that merely support individual human productivity (like “copilots”) into interconnected platforms capable of seamless, autonomous collaboration (acting as “autopilots”).

According to Gartner’s predictions, this evolution will reshape the future of enterprise software in several profound ways:

- Cross-Application Collaboration: By 2028, agentic ecosystems will consist of networks of specialized agents that dynamically collaborate across multiple different applications and business functions. This means users will be able to achieve complex goals without needing to interact with each individual application manually.

- New User Interfaces and Business Models: As these ecosystems mature, an estimated one-third of user experiences will shift away from traditional native applications and move toward “agentic front ends” by 2028. This shift will force the creation of entirely new business models and software pricing structures.

- The “Machine-to-Machine” B2B Economy: Multi-agent AI will soon dominate customer operations, utilizing specialized “subagents” to resolve tasks and accelerate service. Consequently, B2B commerce will be radically altered: by 2028, 90% of B2B purchases are projected to be initiated, evaluated, or completed by AI agents, driving over $15 trillion in automated spending.

- The Death of Traditional SEO: Because software and purchasing will be heavily intermediated by agents, traditional Search Engine Optimization (SEO) will be replaced by “Agent Engine Optimization” (AEO). In this new paradigm, product descriptions, data, and benchmarks must be engineered primarily to be machine-readable so they surface in AI-agent discovery workflows.

- Democratized App Governance: The rise of agentic ecosystems will require a massive shift in workforce capabilities. By 2029, at least 50% of knowledge workers are expected to develop new skills specifically to govern, collaborate with, and even create their own AI agents on demand for complex workflows.

Ultimately, these ecosystems will rely on standardized protocols and frameworks that allow agents to seamlessly sense their environments, orchestrate multi-step projects, and communicate with one another. However, for this vision to succeed, enterprise data architectures will need to provide high-throughput, low-latency data in real-time, as AI agents cannot outperform the infrastructure feeding them.

The Shift from Horizontal to Vertical and Agentic AI

The AI industry is undergoing a structural transformation from general-purpose, horizontal models to highly specialized Vertical AI. Vertical AI is trained on industry-specific “Dark Data” and ingrained with deep domain expertise to handle complex regulatory frameworks and specific enterprise workflows. Concurrently, the market is moving toward Agentic AI—autonomous systems capable of executing complex, multi-step tasks without constant human intervention. Gartner predicts that by 2026, 40% of enterprise applications will feature task-specific AI agents, fundamentally shifting software from individual productivity tools to dynamic “agentic ecosystems”.

Venture Capital and Market Dynamics

AI has become the dominant force in venture capital, accounting for over 61% of all global VC investment in 2025, double its share in 2022. Investment dollars are heavily concentrating in massive “mega deals” for AI infrastructure and foundation models, while funding is drying up for generic “AI wrappers”. Instead, capital is rewarding companies that embed AI deeply into verticalized workflows, create proprietary data moats, and demonstrate clear paths to software-like gross margins (70-80%+).

Industry-Specific Transformations

- Agriculture & Manufacturing: AI is driving physical automation and predictive analytics. John Deere is pioneering autonomous tractors and “See & Spray” technologies that reduce chemical use by up to 76% and operate continuously. In manufacturing, AI-powered predictive maintenance is delivering up to a 10x ROI by reducing unplanned downtime by 30-50% and extending asset lifecycles.

- Legal: Legal AI tools like Harvey are deeply embedding into law firms and corporate legal departments, drastically reducing the time spent on document review and routine drafting. This is driving a power shift, as in-house corporate teams use AI to take on more work internally and pressure outside counsel on pricing.

- Healthcare: A new generation of “Health AI X Factor” companies is bending traditional growth curves. AI is seeing massive adoption in administrative workflows (like medical coding and ambient scribing) and is advancing into clinical diagnostics and triage, provided a “human-in-the-loop” maintains oversight.

Overcoming Legacy Integration Challenges

For traditional enterprises, adopting AI requires overcoming significant integration hurdles. Legacy systems often feature fragmented data silos, outdated architectures, and a lack of interoperability, making AI integration complex and costly. To succeed, organizations are adopting modular “AI overlays,” centralized cloud-native data architectures, and rigorous data governance to ensure their data is “AI-ready”.

The Importance of the AI Tech Stack and Infrastructure

AI’s success is entirely dependent on a robust technology stack spanning five layers: hardware (chips like GPUs, TPUs, and NPUs), cloud infrastructure and data storage, model development, application serving, and governance. Building this infrastructure is highly capital-intensive, leading to a surge in global investments in semiconductor fabs and AI-optimized data centers. Data infrastructure must provide high-throughput and low-latency access to prevent bottlenecks during agentic AI collaboration.

AI Governance, Risk, and Sovereignty

As AI deployment scales, governance and compliance have become board-level imperatives. With the impending enforcement of regulations like the EU AI Act (August 2026) and various US state laws, organizations must implement AI Trust, Risk, and Security Management (TRiSM) frameworks to ensure explainability and prevent physical or financial harm. Furthermore, geopolitical tensions are giving rise to “Sovereign AI,” where countries and enterprises prioritize localized AI infrastructure and data residency to mitigate geopolitical risk.

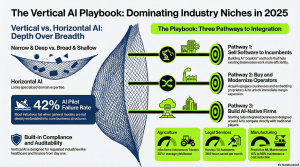

Building a successful vertical AI company requires moving beyond generic, one-size-fits-all models and deeply integrating into the workflows, regulations, and specific data of a single industry.

To capture the margin unlocked by AI, founders must first choose between three distinct structural paths: selling software to existing operators (the traditional SaaS wedge), buying and modernizing existing legacy businesses (an AI roll-up), or building a full-stack AI-native service company from scratch.

Regardless of the chosen path, the strategic playbook for dominating a vertical AI market involves the following key steps:

Map the Ontology

Before writing any code, founders must formally map out the end user’s business ontology. This entails charting the objects that flow through a business, the states they can assume, and the actions that move them from one state to the next. By making these frictions explicit, teams can pinpoint the specific transitions that absorb disproportionate time or headcount and prioritize their R&D efforts accordingly.

Define the Terrain and Feed the “Data Flywheel”

Founders must analyze the market structure to determine the right approach. For example, industries concentrated with micro-operators may be best served by a vertical SaaS tool, whereas mid-sized, owner-operated niches are often ripe for roll-ups and direct ownership. Crucially, the AI must be fueled by proprietary “Dark Data”—such as physician notes, 30 years of PDF blueprints, or seismic data—that general internet-trained models lack. Securing exclusive access to this unstructured corporate data allows companies to fine-tune specialized models that are inherently superior in their niche.

Prove the Value, Then Scale (or Buy)

Because 42% of enterprise AI initiatives fail to deliver measurable results, value creation must be proven before levering up or making acquisitions. The cheapest and most effective way to do this is to pilot the AI inside a customer’s operation or run controlled experiments to ensure the technology actually moves the needle in the real world.

Test the Distribution Wedge

Distributing pure software can be slow and expensive due to long enterprise contracts, heavy onboarding, or reluctant users. Startups need to evaluate their distribution strategy. In some cases, such as property management or parking operations, acquiring an incumbent operator slashes customer acquisition costs and turns existing customer inertia into a defensible moat.

Match Capital and Talent to the Path

Operating a vertical AI company—especially one that takes over existing operations—requires blending technologists with operators and deal leads. If a company pursues a roll-up strategy, the team must possess skills in M&A, debt structuring, integration playbooks, and day-to-day service delivery. If the team lacks these capabilities or the balance sheet to safely carry debt, staying asset-light (selling software) might be the safer option.

Embed Compliance and Auditability

Unlike horizontal AI, vertical AI operates in high-stakes environments where regulatory grounding is non-negotiable. Successful vertical AI must feature built-in support for frameworks like HIPAA, FDA submission requirements, or GDPR, while providing full reasoning trails, citations, and explainability for its decisions.

Evolve from Copilots to Autopilots

Ultimately, the goal is to shift from offering “AI assistance” to providing “AI labor”. Instead of simply documenting or organizing work, successful vertical AI companies build autonomous agents capable of executing complex, multi-step workflows end-to-end. By coordinating decisions and orchestrating processes without constant human intervention, these companies can achieve software-like gross margins (70-80%+) while delivering service-level outcomes.