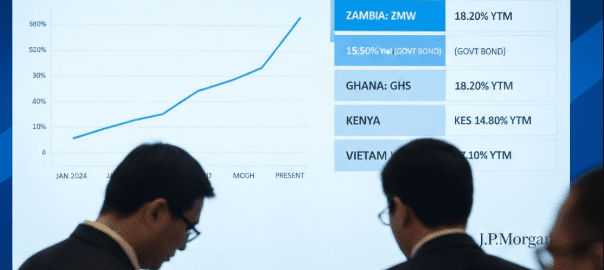

10 Feb. 2026 /Mpelembe Media — New Frontier Benchmark JPMorgan is finalizing plans to launch a new frontier market local currency debt index, aiming to formalize investment in high-yield, developing economies. Expected to include 20 to 25 countries, the index focuses on nations such as Egypt, Vietnam, Kenya, and Nigeria, which are anticipated to carry the heaviest weightings. This launch addresses growing investor appetite for riskier debt, with analysis suggesting that frontier local markets have systematically outperformed mainstream emerging market indices over the last eight years. Continue reading

Tag Archives: Credit risk

Equifax Credit Abuse Risk: Precision Fraud Defense Through Behavioral Intelligence

Jan. 29, 2026 /Mpelembe Media/ — Equifax has introduced a new analytical tool called Credit Abuse Risk to assist financial institutions in identifying and preventing first-party fraud. This predictive model utilizes specialized data to detect loan stacking, where individuals rapidly acquire multiple debts, and credit washing, which involves the illegitimate removal of negative history from reports. By providing real-time behavioral insights and actionable scores, the system allows lenders to adjust their terms safely while maintaining high standards of regulatory compliance. Ultimately, this innovation functions as a layered defense mechanism intended to stabilize the lending market and protect the integrity of consumer credit profiles. Continue reading

Equifax Launches “Employment Insights” to Streamline Auto Financing with Verified Data

Jan. 29, 2026 /Mpelembe Media/ — Equifax has introduced a pair of new Employment Insights tools tailored specifically for automobile retailers. These resources integrate verified job and income data from The Work Number directly into standard consumer credit reports to provide a more transparent financial overview of potential buyers. The first tool assists with prequalification by gauging a customer’s true purchasing power, while the second supports the financing stage by confirming application details to minimize lending risks. By moving away from self-reported information, dealerships can offer more accurate loan terms and accelerate the overall car-buying process. Ultimately, these digital solutions aim to help the automotive industry make faster, data-driven decisions while improving the consumer experience. Continue reading

79% of risk pros prioritize credit risk transformation in race to digitalize banking

Regulatory demands, calls for greater transparency and accessibility, plus customers jumping ship to more agile fintech counterparts – banks are feeling pressured to enact a digital revolution, according to risk professionals on the ground. A key pillar of this modernization, credit risk transformation (CRT), is the focus of a new risk technology study by the Global Association of Risk Professionals (GARP) and analytics leader SAS. Continue reading