Americans overwhelmingly say that when they think about longevity, it’s more than just living longer—it’s about living their healthiest, best lives. While most want to live to 90—well past the average U.S. life expectancy of 77.5 years—nearly two-thirds (66%) would choose a shorter, healthier life over a longer one with health issues. Continue reading

Tag Archives: Actuarial science

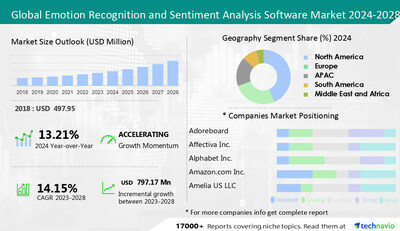

The emotion recognition and sentiment analysis software market to grow by USD 797.17 million from 2023 to 2028; North America accounts for 44% of market growth – Technavio

The emotion recognition and sentiment analysis software market size is estimated to grow by USD 797.17 million from 2023 to 2028, according to Technavio. The market is estimated to grow at a CAGR of 14.15% during the forecast period. Continue reading

Crisis24 global risk predictions for 2024 include increased cyber warfare, supply chain disruptions, AI impacts

Crisis24, a GardaWorld company and leading integrated risk management, crisis response, consulting and global protective solutions firm, today unveiled its annual Global Risk Forecast, which provides expert insight and analysis on a variety of risks businesses and organizations may face in 2024. Continue reading

What to do in a ship fire like that of the Fremantle Highway?

The large ship fire on the Fremantle Highway has once again shown that the transport of electric cars entails other risks. The approach to an incipient fire also requires a different approach. And while the fire on the Fremantle Highway ended relatively well, it was close to a bigger disaster. That is why FMTC, specialist in safety training for the offshore and maritime sector, among others, provides more insight into the specific characteristics of a ship fire with a high-risk cargo, such as electric cars. How does such a fire start, how do you fight it and what measures can you take to prevent a recurrence of this near-disaster? Continue reading

War, what is it for?

London, May 4, 2023 /World/ — War is a complex phenomenon with many causes and consequences. It is often about killing, but it is also about much more than that. War can be about power, control, resources, ideology, or even just a misunderstanding. It can be fought between nations, groups, or even individuals. And it can have a devastating impact on all involved, both during and after the conflict.

There are many different theories about why war happens. Some people believe that it is an inevitable part of human nature, while others believe that it is caused by specific factors, such as poverty, inequality, or environmental degradation. There is no single answer that can explain all wars, but it is clear that they are often caused by a combination of factors.

The consequences of war can be just as devastating as its causes. War can lead to death, destruction, displacement, and economic hardship. It can also contribute to the spread of disease, famine, and violence. In the long term, war can undermine democracy, stability, and economic development.

Despite the risks and costs of war, it is important to remember that it is not inevitable. There are many things that can be done to prevent war, such as promoting diplomacy, resolving disputes peacefully, and addressing the root causes of conflict. We must all work together to create a world where war is no longer an option.