Stablecoins Come of Age: Navigating Landmark Regulations, Global Adoption, and the Rise of Yield-Bearing Tokens

Feb 19, 2026 /Mpelembe media/ — By late 2025 and early 2026, the global stablecoin market has transitioned from a niche crypto-trading utility into core financial infrastructure, processing trillions of dollars in annual transaction volume. This evolution is defined by the implementation of landmark regulatory frameworks—most notably the U.S. GENIUS Act and the EU’s MiCA regulation—which have established strict operational standards and legitimized the asset class. Simultaneously, the market has seen a surge in institutional adoption and a significant structural shift toward yield-bearing and synthetic stablecoin models. However, despite these advancements, recent market shocks underscore that systemic vulnerabilities, such as liquidity crunches and de-pegging risks, remain persistent threats.

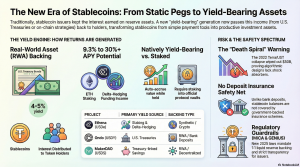

Introduction: The End of the “Zero-Yield” Dynasty

In the contemporary landscape of digital finance, the juxtaposition is stark: traditional commercial bank savings rates remain stagnated near zero, while on-chain protocols are aggressively marketing “12% APY” on dollar-denominated assets like USDC. This isn’t merely a marketing anomaly; it represents a fundamental structural pivot in global liquidity.For years, stablecoin issuers operated within a lucrative “zero-yield” dynasty. They captured billions in user deposits, recycled that “float” into interest-bearing U.S. Treasuries, and internalized 100% of the net interest margin. That era of unilateral profit is ending. We have entered the 2025-2026 “dividend phase,” a period where the market is forcing the redistribution of Treasury yields back to end-users. This shift is a primary growth driver for the broader Real-World Asset (RWA) sector, transforming stablecoins from simple payment “pegs” into sophisticated, productive assets that redefine the relationship between cash and yield.

The Great Interest Redistribution: Why Your “Cash” is Now a Revenue Stream

The legacy stablecoin model effectively turned issuers into sovereign-scale financial titans. By July 2025, Tether (USDT) ascended to become the 18th-largest holder of U.S. Treasuries globally, surpassing the national holdings of South Korea.”Tether’s $4.9B Q2 operating profit underscores the potency of this model. By holding over $ 157 billion in U.S. government securities ($105.5B held directly), the issuer converts deposits into a massive, low-risk revenue engine with near-zero cost.” — imToken AnalysisHowever, the “dividend phase” has birthed a new taxonomy of productive money. Digital Finance Strategists now distinguish between two primary paths for yield capture:

Natively Yield-Bearing Tokens: These are assets where the yield is embedded in the token’s logic. A prime example is Ondo’s USDY , which functions as a tokenized note backed by Treasuries and demand deposits. Holders accrue value simply by retention, effectively utilizing a bearer-style claim on institutional-grade fixed income.

Official Yield Routes: These assets do not auto-accrue value but provide “official” protocol-level earnings paths. Sky’s (formerly Maker) sUSDS falls here; users must utilize the Sky Savings Rate (SSR) to capture the protocol’s RWA-driven revenue.This redistribution shifts the stablecoin’s role from a mere transactional “peg” to a “dividend” asset, fundamentally altering user expectations of their digital cash.

The $8 Billion Warning: Why Synthetic Stability is Still Fragile

While high-yield models like Ethena’s USDe offer attractive returns—often exceeding 9.3%—they introduce significant crypto-native risks. USDe’s yield is a composite of ETH liquid staking rewards (~4%) and Delta-hedging funding income derived from shorting perpetual futures. Unlike fiat-backed tokens, USDe relies on a “Delta-neutral” strategy rather than 1:1 cash rehypothecation.In October 2025, this model faced a severe stress test. A temporary depegging event on Binance eroded confidence, exposing USDe’s vulnerability to shifting perpetual funding rates . The result was a brutal “liquidation cascade” where Total Value Locked (TVL) plummeted from $14.8 billion to $7.4 billion. The velocity of the exit was unprecedented, with $ 5.7 billion redeemed in October alone as investors fled the threat of a “death spiral.”Insight Block: Lessons from the Fall

2022 (Terra Luna): Demonstrated that purely algorithmic, uncollateralized models lack the “shock absorbers” to survive a total break in market confidence.

2025 (Ethena): Proved that even “Delta-neutral” synthetic dollars are vulnerable to extreme liquidity shocks and negative funding rate environments.

The Merchant’s Paradox: Why Better Systems Might Mean Higher Fees

Research from BIS Working Paper No. 1301 highlights a counter-intuitive outcome in the evolution of payment “industrial organization.” Central banks are currently choosing between Central Bank Digital Currencies (CBDCs) and Fast Payment Systems (FPS) to dismantle the private “walled gardens” of platforms like AliPay, WeChat Pay, and M-Pesa.The BIS identifies an “Equivalence Result” between CBDCs and FPS: both drive financial inclusion by enforcing interoperability. However, the “Merchant’s Paradox” suggests that as these systems become more integrated, merchant fees may actually increase.Counter-Intuitive Insight: The Interoperability Tax Interoperability “softens the competition” for merchants. In a world of fragmented “walled gardens,” platforms compete aggressively to capture a merchant’s exclusive loyalty. Once a system becomes interoperable, the merchant can accept all forms of digital money through any provider. This makes the merchant’s demand for any specific service less elastic, allowing intermediaries to maintain—or even raise—fees without the fear of losing the merchant to a competitor.

The Regulator’s Red Line: The Global Crackdown on “Yield” and “Algorithms”

Global authorities are moving swiftly to close the “regulatory gaps” that allow stablecoins to function as shadow banks. In the U.S., the passage of the GENIUS Act has established a federal framework for 1:1 liquid reserve backing, while the pending Digital Asset Market Clarity Act (CLARITY Act) seeks to resolve the jurisdictional tug-of-war between the SEC and CFTC.Regulators have coalesced around a three-tiered approach to Crypto Asset Service Providers (CASPs) and yield:

- Complete Prohibitions: Under MiCA (EU) and the Stablecoins Ordinance (Hong Kong), issuers and CASPs are strictly forbidden from paying interest to holders.

- Restricted Access: Singapore permits yields only for accredited professional investors, banning interest-bearing products for retail users.

- The U.S. Hybrid: While no explicit federal ban on CASP yield exists, the CLARITY Act intends to enforce transparency and mandate that products mimicking savings accounts be classified as investment contracts.Key Risks Identified by Regulators:

Runnability: The risk of mass redemptions in yield-seeking cohorts during market stress.

Consumer Protection Gap: Unlike commercial bank deposits, yield-bearing stablecoin accounts lack government-backed deposit insurance .

Conflicts of Interest: CASPs acting simultaneously as custodians, exchanges, and lenders create operational interdependencies that threaten market integrity.

The $33 Trillion Inevitability: 2026 Adoption Statistics

Despite regulatory headwinds, the integration of stablecoins into core financial infrastructure is now a mathematical certainty. By early 2026, annual stablecoin transaction volume surpassed $33 trillion , rivaling the settlement scale of legacy networks like Visa.The scale of the “Stablecoin Era” is defined by four key data points:

Explosive Usage: Active stablecoin usage grew 146% year-over-year , supported by an estimated 1.4 billion Stablecoin-Ready Accounts (SRAs) globally.

Mass Participation: Active global users have reached 316 million , with 64% of all businesses planning to integrate stablecoin settlements by 2028.

The U.S. Dominance: The United States maintains a massive lead in on-chain dollar transfers, reporting a 690% growth in transaction volume over the last cycle.

Regional Grassroots: In Argentina, stablecoin usage has exceeded 40% of the adult population as a hedge against local currency volatility, while India leads APAC as the fastest-growing hub for on-chain activity.

Conclusion: The Future of Productive Money

The next decade of finance will be characterized by the tension between traditional banking safety and programmable, RWA-backed productivity . Stablecoins have successfully transitioned from niche trading tools to a $33 trillion infrastructure layer that bridges the gap between the speed of the internet and the stability of the dollar.As the industry matures, the “hold-to-earn” model will continue to challenge the very definition of a “deposit.” Investors and businesses now face a defining choice: Will they prioritize the “risk-free” 0% yield of a traditional bank account, or embrace the higher-risk, 5-12% yield of a regulated, productive digital dollar? The answer to that question will determine the ultimate winners of the $33 trillion shift.