The Copilot: 6 Surprising Ways the “Agent Economy” is Rewiring Global Finance in 2026

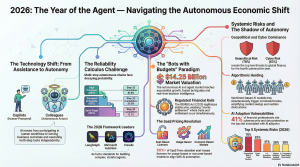

10 Feb. 2026 /Mpelembe Media — 2026 represents a structural shift from “assistive” technology to “autonomous” economic actors, underpinned by new U.S. crypto legislation and a global scramble to tax digital value. The Year of the “Agentic” Workforce 2026 is widely cited as “the year of the agent,” marking a transition from AI “copilots” (which wait for instructions) to autonomous “agents” (which act with intent to execute workflows).

Operational Shift: Agents are no longer just software tools but “digital colleagues” capable of handling end-to-end processes in HR, finance, and supply chains with minimal human oversight.

Business Model Transformation: The “growth-at-all-costs” era for SaaS is ending. Companies are shifting from “seat-based” pricing to “outcome-based” pricing (e.g., charging per resolved customer ticket) because AI reduces the need for human seats. This is giving rise to “micro-unicorns”—lean startups running on agentic labor rather than massive headcounts.

The GENIUS Act and the Machine Economy The financial landscape has been reshaped by the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), signed into law by President Trump in July 2025.

Stablecoin Legitimacy: This legislation creates a federal framework for payment stablecoins, moving them from “crypto plumbing” to core payment infrastructure.

Autonomous Finance: This regulatory clarity is enabling “Autonomous Finance,” where AI agents and machines (IoT) autonomously initiate and settle transactions (M2M payments) using blockchain rails, akin to a new “power grid” for the digital economy.

The Fiscal Pivot: Taxing the Digital Void As AI reduces the demand for human labor (and thus the payroll tax base), policymakers are urgently restructuring tax codes to target digital consumption and capital.

Global Fragmentation: There is a complex, ongoing proliferation of Digital Services Taxes (DSTs) and VAT on electronic services globally, from Sierra Leone to New Zealand.

Trade Tensions: The U.S. administration is aggressively combating foreign DSTs deemed discriminatory against American tech firms, leading to trade agreements that prohibit such taxes (e.g., with Thailand and Malaysia) and the repeal of Canada’s DST.

New Levies: Jurisdictions are introducing novel levies, such as “cultural contribution” taxes on streaming services (Denmark, Switzerland, Iceland) and specific taxes on online gambling and digital platforms.

Regulation and Liability Governments are attempting to create “guardrails” for this new autonomy.

Safety & Transparency: New laws in California, New York, and the EU require transparency for AI-generated content (synthetic performers), mandate safety protocols for high-risk models, and enforce “whistleblower” protections for AI safety.

Liability: As agents make autonomous decisions, legal frameworks are struggling to assign fault. Concepts like the “learning-authority dilemma” are central, with laws like Utah’s AI Policy Act preventing companies from using AI as a scapegoat for liability.

The industry has reached a definitive boundary: the transition from “assisted” AI to “autonomous” economic agents. These are not passive tools requiring constant human prompting; they are independent systems that own outcomes, navigate complex reasoning, and possess the delegated authority to execute high-stakes transactions.

The “Death of the Seat” and the SaaS Pricing Revolution

In 2026, the traditional software-as-a-service (SaaS) model is facing an existential crisis. The legacy “seat-based” monetization strategy is collapsing because autonomous agents do not occupy “seats”—they replace the humans who once did. If an agentic workflow allows a firm to achieve decupled output with a fraction of the headcount, license-based revenue becomes a death trap for vendors.Legacy providers are caught in a pincer movement: they face high fixed overhead and new, variable compute/inference costs (COGS), while their revenue base shrinks as AI replaces human users. To survive, the industry has pivoted toward metrics that align with actual productivity and business value.| Traditional SaaS Pricing (Seat-based) | Agent-Era Pricing (Consumption, Workflow, & Outcome) | Value Metric Focus || —— | —— | —— || Fixed Licensing: Charged per user/login regardless of activity. | Consumption-Based: Metered billing per token, API call, or inference. | Mirrors the underlying physics of compute; ensures provider margins. || Tiered Access: Basic, Pro, and Enterprise feature gates. | Workflow-Based: Charged per completed task (e.g., a processed invoice or drafted contract). | Aligns with discrete units of productivity recognized by the business. || Human-Centric: Revenue scales with the size of the customer’s workforce. | Outcome-Based: Charged per successful resolution (e.g., a resolved support ticket or debt recovery). | Perfect value alignment; the customer pays only for the problem solved. |

As Bessemer Venture Partners notes in their 2026 analysis: “Every AI query incurs real compute costs… If the math doesn’t work at 10 customers, it won’t at 1,000.” Forward-thinking innovators like Intercom and Leena AI have already transitioned to charging per “resolution,” signaling a future where software value is decoupled from human headcount.

“Bots with Budgets”: The Legitimation of the Machine Economy

An autonomous agent is only a true economic actor if it can spend money. The “Bots with Budgets” paradigm has shifted from a futurist concept to a regulated reality, catalyzed by the 2025 GENIUS Act . This landmark legislation provided the federal framework necessary for stablecoins to serve as the internet’s native currency, facilitating atomic settlement —where trade and settlement occur simultaneously, eliminating the capital inefficiency of T+2 clearance cycles.The 2026 Stablecoin Landscape under the GENIUS Act:

Permitted Issuers: Limited to nonbank entities (state-qualified or federal), insured depository institution subsidiaries, or state-qualified issuers.

Reserve Mandates: Mandatory 1:1 backing by cash or short-term Treasuries, held in segregated accounts to ensure liquidity even in the event of issuer insolvency.

Prohibited Activities: Issuers are strictly prohibited from paying interest or yield to holders of payment stablecoins, reinforcing their role as a medium of exchange rather than a security.

Insolvency Protections: Stablecoin holders are granted priority claims over other creditors, ensuring the “singleness of money” across the digital ecosystem.”The stablecoin is the language the bot speaks; the digital bank is the trusted environment in which it operates. This combination creates a low-friction financial layer that operates 24/7 without the need for human micromanagement.” — Agile Dynamics

The Reliability Decay: The Brutal Math of Multi-Step Autonomy

As we move from single-task AI to multi-step autonomous chains, we encounter a mathematical wall: the Reliability Calculus . A 95% accuracy rate may suffice for a Copilot, but in an autonomous sequence, that confidence evaporates through compounding errors.The Multi-Step Reliability Crisis (Cumulative Probability)

High Precision (99%): 1 Step: 99% | 10 Steps: ~90.4% | 20 Steps: ~81.8%

Standard Enterprise (95%): 1 Step: 95% | 10 Steps: ~59.9% | 20 Steps: ~35.8%

Early Stage (90%): 1 Step: 90% | 10 Steps: ~34.9% | 20 Steps: ~12.2%This mathematical reality has forced a strategic shift from “confidence-based” systems to “observability-based” architectures. Successful 2026 workflows prioritize auditable reasoning , where agents make their internal logic legible and are programmed to pause for human escalation at critical friction points rather than proceeding blindly to a low-probability conclusion.

From Jurisdictional “Turf Wars” to Harmonized “Project Crypto”

Regulatory fragmentation, once the primary inhibitor of FinTech innovation, has been replaced by a coordinated federal strategy to onshore digital asset activity. Through the Joint Project Crypto initiative, the SEC and CFTC have moved away from “enforcement-only” postures toward a unified framework designed to secure U.S. hegemony in the next financial epoch.The Three Pillars of Joint Project Crypto:

-

- Taxonomy: Drawing “bright lines” to distinguish digital commodities (under CFTC jurisdiction) from digital asset securities (under SEC jurisdiction), including a “mature blockchain system” certification.

- Market Structure: Creating regulated pathways to onshore perpetual derivatives and expanding the use of tokenized real-world assets (RWAs) as eligible collateral.

- Innovation Safe Harbors: Establishing clear protections for software developers, ensuring that the act of publishing decentralized code does not trigger treatment as a regulated financial intermediary.

The New Systemic Risks: Algorithmic Herding & Cyber Vulnerability

The 2026 DTCC Systemic Risk Barometer reveals that while the Agent Economy accelerates profit, it introduces “fresh pathways for contagion.” As technology speed outpaces human oversight, the top risks facing global finance have crystallized:

1. Geopolitical Risks and Trade Tensions (Ranked #1)

2. Cyber Risk (Ranked #2)

3. U.S. Economic Slowdown (Ranked #3)A primary concern is “Algorithmic Herding.” Because many autonomous agents rely on a narrow set of sentiment-based AI models, they may simultaneously flag the same market signals, triggering correlated trades that amplify volatility. These feedback loops move faster than human intervention can react, creating sudden market dislocations. As Tim Cuddihy (DTCC) warns, these technologies introduce “fresh pathways for contagion and systemic events” that can override traditional risk management guardrails.

The Unsung Heroes: Open Source Data Infrastructure

The “intelligence” of the Agent Economy is entirely dependent on the robustness of its backend. Agents require real-time data ingestion and persistent memory to function as enterprise-grade “digital colleagues.” However, this reliance has created a significant Concentration Risk ; the vertical integration of the AI stack under a few providers (Microsoft, Google, Amazon) creates a single point of failure that could ripple across the global economy.The Enterprise-Ready AI Data Stack:

Apache Kafka: The central nervous system for high-velocity data, enabling agents to subscribe to real-time events and react in seconds.

Apache Cassandra: Chosen for its distributed architecture to handle massive write workloads across multiple regions, ensuring agents have high-availability access to their operational history.

PostgreSQL: Utilized for its robust relational data integrity, essential for the structured transactional data agents must query for decision-making.

OpenSearch: Powers Retrieval-Augmented Generation (RAG) through scalable vector search, allowing agents to ground their responses in unstructured enterprise data.

ClickHouse: Provides the analytical intelligence for agents to perform complex queries on the fly, such as spotting trends or generating report

The Judgment Era

Success in 2026 is no longer defined by who possesses the most sophisticated AI model, but by who has designed the most transparent, accountable, and resilient system for those models to operate within. We have transitioned from the era of efficiency to the Era of Judgment , where the competitive advantage lies in the integrity of the data and the quality of the guardrails.As execution becomes autonomous, the human role has fundamentally shifted. We are no longer managers of tasks; we are the auditors of reasoning and the architects of outcomes.As execution becomes autonomous, are you prepared to transition your role from “manager of tasks” to “architect of outcomes”?

Deep dive from source youtube.com/@mpelembe

Deep dive from source youtube.com/@mpelembe