The “Seat” is Dead: 5 Surprising Truths About Monetizing Software in 2026

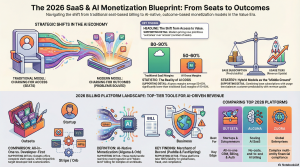

Feb 19, 2026 /Mpelembe media/ — Most SaaS founders approach their billing infrastructure with the same level of strategic rigor they use to pick lunch: they go with what’s familiar, what’s easy, or what their neighbor recommended. But in 2026, treating billing as a back-office utility rather than a core product feature is a recipe for subsidized growth and eventual insolvency. For a company at $2M in Annual Recurring Revenue (ARR), the cost of this “lunch-pick” mentality is staggering—up to $100,000 lost every year due to billing errors, missed renewals, and failed payments.We have entered a landscape where the “physics of compute” has rewritten the rules of the game. As venture-backed startups navigate a world dominated by AI and usage-driven models, the traditional seat-based license has become a relic. To thrive, founders must move past simple subscription summaries and understand that monetization is now a continuous discipline of research, iteration, and negotiation.

Truth #1: Your Biggest Churn Problem Isn’t Your Product—It’s Your Infrastructure

While product teams obsess over feature engagement and UX friction, the most significant revenue leak is often completely invisible: involuntary churn. Data across the ecosystem reveals that 20% to 40% of all churn is caused by billing system failures rather than customer dissatisfaction. These are users who intended to stay, but whose transactions failed due to rigid retry logic or outdated payment processing.From a Chief Revenue Officer’s perspective, this represents a catastrophic waste of capital. Every failed renewal is a marketing dollar poured down the drain. You are essentially paying to acquire customers only to let your infrastructure usher them out the back door. The market is shifting toward intelligent recovery; for instance, platforms like Recurly now utilize aggressive machine learning to recover an average of 12% of lost revenue that standard gateways simply let go. As the source material notes: “Recurly… uses aggressive machine learning… to recover failed payments that other platforms simply let go.” If your billing stack isn’t actively fighting for every dollar, it’s not just a utility—it’s a liability.

Truth #2: The 80% Gross Margin Dream is Over (for AI)

For the better part of two decades, the SaaS industry was built on the back of 80-90% gross margins. In that era, serving the next user was essentially free. AI has shattered that economic foundation. In 2026, delivering software incurs material unit costs—compute and inference expenses that compress margins to the 50-60% range.The mistake most founders make is treating AI tokens as “free,” similar to how they treated database calls in the 2010s. This is a fundamental misunderstanding of the “physics of compute.” In the AI era, scaling is no longer a “growth at all costs” game; it is a unit economics game. If the math doesn’t work at 10 customers, the high cost of inference ensures it certainly won’t work at 1,000. Every AI query carries a non-trivial expense, meaning the old “access-based” pricing models are effectively subsidizing your customers’ compute at your own expense. As Bessemer Venture Partners warns, “Unlike traditional software, delivering AI isn’t free… every AI query incurs a non-trivial expense.”

Truth #3: We’ve Moved from the “Access Era” to the “Value Era”

We are witnessing a shift from the “Access Era”—where users paid for a login—to the “Value Era,” where they pay for outcomes. This is the difference between a Copilot (Soft ROI) and an Agent (Hard ROI). A Copilot offers advice and sits beside a human, but it doesn’t “close the loop,” often leaving customers questioning the actual value provided. Conversely, Agents perform autonomous work, such as Intercom charging $0.99 per resolution rather than per message sent.This transition is the only way to protect margins in a high-compute world. By shifting to outcome-based metrics—like automated claim processing in healthcare—you align your revenue directly with the customer’s success. However, this creates a “2026 renewal cliff.” Products offering only advice or “sidekick” functionality will struggle to justify their cost against agents that deliver hard, measurable ROI by completing tasks autonomously. The companies that win will be those that accept cost variability in exchange for perfect value alignment with the customer.

Truth #4: “Tool Sprawl” is a Hidden Transaction Tax

The standard startup stack—Stripe for billing, Auth0 for auth, HubSpot for CRM, and Mailchimp for email—has become a “tool sprawl” tax on growth. Beyond the data syncing nightmares, there is a literal financial toll: many founders pay an extra 0.7% per transaction in “Stripe Billing” fees alone, just to keep these disparate systems talking to each other.As a strategy architect, I see this not just as a financial leak, but as a velocity killer. Integration nightmares act as “infrastructure glue,” preventing the very “Research → Iterate” cycle necessary to stay competitive. When your pricing logic is hard-coded across four different platforms, you cannot pivot your strategy in response to market shifts. The complexity becomes a bottleneck that throttles monetization experiments. True agility in 2026 requires an end-to-end monetization engine that eliminates the .7% hidden tax and allows RevOps to own the pricing logic without a six-week engineering sprint.

Truth #5: If Your Customers Buy Instantly, You’re Losing Money

Many founders fall into the “cost-plus pricing trap”—they calculate their delivery costs, double them, and hope for the best. This instinct is driven by a fear of friction, but “Value-First” pricing requires a different mindset. If your customers say “sold” the moment they see the quote, you are leaving significant money on the table.The most successful companies in 2026 find their pricing sweet spot through friction, not spreadsheets. This involves raising prices incrementally until you hear, “we have to think about that.” To balance this, Bessemer suggests a hybrid formula: Platform Fee (set at 2x delivery costs) + Outcome Credits. This structure ensures your baseline costs are covered while allowing you to capture the upside of the work your software actually completes. It moves the conversation from “what does this cost us?” to “what is this worth to the customer?” As the guiding principle goes: “Find your pricing sweet spot through friction, not spreadsheets.”

Conclusion: The 2026 Renewal Cliff

As we move deeper into 2026, the “AI adoption at all costs” era of 2025 is meeting a new wall of budget scrutiny. This is the “Renewal Cliff.” Billing is no longer a back-office utility; it is a strategic statement. The companies that thrive will be those that treat monetization as a continuous discipline—constantly researching value drivers and iterating on their packaging.Success in this era requires infrastructure that can handle the complexity of the “Value Era” without sacrificing operational velocity. Your monetization strategy is the ultimate reflection of what your software is worth.Is your software still charging for access, or is it finally ready to get paid for the work it actually completes?

Source: MonetizationOS