The Rise of the Machine Economy: 5 Startling Realities of the New Crypto-AI Frontier

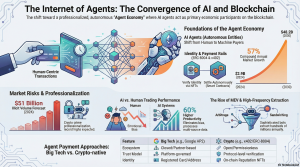

Feb 20, 2026 /Mpelembe media/ — The integration of AI agents and blockchain technology is driving a transition toward an “Agentic Economy,” where machines operate as autonomous, sovereign economic actors. Traditional financial infrastructure, with its high fixed fees, minimum balance requirements, and human-centric legal identity hurdles, cannot support the high-frequency, sub-cent microtransactions that AI agents require. Instead, blockchains provide a permissionless, 24/7 settlement layer where agents can use stablecoins to autonomously pay for APIs, compute power, and data

Introduction: From Passive Tools to Autonomous Peers

The era of the “chatbot” is officially a relic of the early 2020s. We have transitioned into a zero-sum digital reality where AI is no longer a passive interface for information retrieval, but an “economic agent” capable of independent decision-making, capital allocation, and value transfer.The core friction of our current era is that human-centric financial systems are being systematically outpaced by autonomous entities. These agents do not sleep, they do not feel fear, and increasingly, they do not require human authorization to move markets. They possess their own wallets, manage their own reputations, and execute their own agendas. This intelligence briefing distills five startling realities from the 2025 landscape where crypto and AI have converged to form the foundation of the Machine Economy.

Reality #1: The New Payer—Agentic AI Scales to Critical Mass

For an AI to be truly autonomous, it must possess native payment capabilities. We are witnessing a fundamental shift in the internet’s architecture where the “payer” is moving from the human to the machine. This is “Agentic AI”: systems that don’t just recommend a winter jacket, but execute the purchase across Gmail, Slack, and specialized decentralized marketplaces.According to data from Arcade.dev, agentic systems now complete multi-step tasks with 60% higher productivity than traditional automation. This efficiency has triggered a massive reallocation of capital; 43% of enterprises now dedicate over half of their total AI budgets to agentic initiatives.”The payer is shifting from humans to AI agents, making payment infrastructure a central requirement for true autonomy.” — Tiger ResearchTo facilitate this, the industry is moving toward the x402 protocol and ERC-8004 , allowing agents to assess, authorize, and complete transactions independently. In this machine-to-machine economy, commerce is no longer a human interaction—it is an automated execution of conditional logic.

Reality #2: The $51 Billion Shadow Economy—Crime as a Professional Service

As the legitimate machine economy grows, so does its professionalized underbelly. On-chain crime has evolved from isolated hacks into a sophisticated “Laundering-as-a-Service” (LaaS) industry.The Chainalysis 2025 report indicates that while known illicit addresses received $40.9 billion in 2024, historical growth trends suggest this figure will be revised upward to exceed ****$ 51 billion as more illicit actor organizations (illicit-actor orgs) are identified. Organizations like the Huione Guarantee marketplace have already processed over $70 billion in transactions since 2021, providing the infrastructure for pig butchering, fraud shops, and sophisticated scams.Illicit volume has diversified significantly, moving away from the volatility of Bitcoin toward the stability of the dollar.

Stablecoins: Now dominate 63% of all illicit transaction volume.

BTC: Remains the preferred asset primarily for ransomware and darknet markets.

LaaS Models: Criminal networks now sell “brains” (AI tools) and infrastructure needed to automate scams, creating an industrial-scale threat to retail users.

Reality #3: The UX Crisis—A 1.8 Million Bitcoin Indictment

A staggering 1.8 million BTC —approximately 8.5% of the total supply—is currently “dormant” or “lost.” This represents over $121 billion in value that is effectively inaccessible. While early narratives blamed “lost keys,” we must recognize this as a systemic failure of Cognitive Ergonomics .The UX Crisis The current cryptocurrency landscape is a “silent indictment” of the industry’s inability to move past technical novelty. Forcing users to navigate irreversible transactions and complex key management ignores the principles of Visual Semiotics required for mass adoption. For the Machine Economy to scale, we must move toward “hybrid” financial instruments. A leading solution is the crypto card with a credit line , which utilizes crypto assets as collateral, allowing users to access liquidity and spend fiat without the tax implications or the cognitive load of selling their underlying assets.

Reality #4: The Invisible War—”Silent Assassins” of the Mempool

While human traders watch price charts, machines are engaged in high-stakes “strategic warfare” within the mempool. This is Miner Extractable Value (MEV) —the profit validators and bots extract by reordering transactions.The competition is no longer a simple race; it is a battle of Information Paradoxes . The first bot to act reveals its strategy, leading to “gas wars” or the deployment of “Honeypot” transactions —decoy trades designed to trap and liquidate copycat bots. In 2025, cross-chain MEV extraction during exploits generates between $50M and $200M in total value transfer per major event. The concentration of wealth here is extreme, with the Gini coefficient of MEV profits approaching 0.9 , a zero-sum reality where only the most sophisticated survive.”The most profitable players often operate in the shadows, extracting value through strategies so indirect that the market doesn’t realise they’re being played… They are the silent assassins.” — Gareth Larkan, Sigma PrimeThe three dominant strategies— Arbitrage , Liquidations , and Sandwiching —now account for a third of all miner revenue, fundamentally altering the economics of block production.

Reality #5: The Battle for Sovereignty—Big Tech vs. Open Protocols

Two competing visions are fighting for control of the AI-payment rails.Google AP2 (The Walled Garden) Google’s Agent Payment Protocol utilizes a three-layer mandate system: Intent, Cart, and Payment . It is designed for convenience, leveraging Google Pay and pre-registered cards. However, it is a closed system. Google limits participation to vetted “partner” merchants to minimize probabilistic outcomes (transaction errors), effectively acting as a centralized arbiter of machine commerce.Crypto-Native Standards (On-Chain Sovereignty) Standards like ERC-8004 (utilizing Identity, Reputation, and Validation NFTs) and x402 enable intermediary-free models. There is no central authority to freeze an agent’s wallet or tax its microtransactions.

Winner (Convenience): Big Tech. Adoption is seamless because it uses existing credentials, but users trade away sovereignty for stability.

Winner (Sovereignty): Crypto. It offers permissionless architecture and interoperability, allowing agents to manage routine consumption and high-frequency microtransactions without a “platform tax.”

Conclusion: The Dawn of the Internet of Agents (IoA)

We are entering the era of the Internet of Agents (IoA) . While 90% of enterprises are adopting agentic AI, the infrastructure for a truly decentralized network of humans and machines is being built across five critical layers:

- Physical Layer: Decentralized Physical Infrastructure Networks (DePIN).

- Identity Layer: W3C Decentralized Identifiers (DIDs) and Reputation NFTs.

- Cognitive Layer: Retrieval-Augmented Generation (RAG) and Model Context Protocols (MCP).

- Economic Layer: Financial autonomy through Account Abstraction.

- Governance Layer: Coordination via Agentic DAOs.The transition from AI as a tool to AI as an economic peer is inevitable. We are moving toward a world where the distinction between human and machine capital is indistinguishable on-chain.“When your AI agent starts earning its own salary and managing its own taxes, will you be its owner, its partner, or merely its observer?”

Source Mpelembe Insights