Central banks are faced with the ongoing debates – Should retail and wholesale clearing and settlement of CBDC payments be separated? The differentiation doesn’t matter to the average citizen user. Their primary concern is to have a straightforward, secure, and all-encompassing solution that enables them to transfer value easily and affordably, regardless of their access to a bank or mobile/internet connectivity. Continue reading

Category Archives: Finance

The current state of open banking regulation around the world.

April 25, 2023 /Finance/ — Open banking is a financial services term for the practice of allowing third-party financial service providers to access customer data held by other financial institutions, through the use of application programming interfaces (APIs). The goal of open banking is to promote innovation and competition in the financial services industry by giving consumers more choices and control over their financial data. Continue reading

ChatGPT: how to use AI as a virtual financial adviser

Eun Young (EY) Oh, University of Portsmouth

From chatbots and virtual assistants to fraud detection and risk management, artificial intelligence (AI) is now being used in many areas of finance. But what could an AI system like ChatGPT do for your bank balance?

AI tools might seem overly complex or expensive to non-experts, but advances in natural language processing and machine learning could turn ChatGPT and similar products into virtual personal finance assistants. This would mean having an expert on hand to help you make sense of the latest financial news and data.

Viva Wallet and Elo partnership disrupts legacy checkout and embeds all payments into Elo mobile Android computers.

The strategic partnership between Viva Wallet, a leading European cloud-based neobank, and Elo, a leading global supplier of interactive touch solutions, is pioneering a new retail payments experience. European businesses can now offer new payment experiences, accepting Chip & PIN and Tap-on-Phone contactless payments by combining Viva Wallet’s cutting-edge embedded payments platform for smart devices, with Elo M50 and M60 Pay mobile computers in an enterprise-grade mobile point of sale system. One piece of technology that integrates smart retail software and payment acceptance for each and every transaction into a powerful and robust handheld Android computer; anywhere, anytime, seamlessly, all from the palm of your hand. Viva Wallet and Elo’s strategic alliance, featuring additional omnichannel solutions, has gone live in Europe with plans to expand globally, including the US. Continue reading

First ammonia future traded

Global energy and commodity price reporting agency Argus announced that the first-ever futures ICE Ammonia Outright – Argus Ammonia NWE CFR Future contract has traded between counterparties in a deal brokered by Freight Investor Services (FIS). The 5,000-tonne futures contract was traded at $385/t for May delivery and cleared through ICE. Continue reading

The National Pension Scheme Authority (NAPSA) of Zambia allows partial pension withdrawals

April 18, 2023 /Finance/ — The law allows NAPSA beneficiaries to withdraw a portion of their pension savings before they reach retirement age. The amount that can be withdrawn is limited to 50% of the accumulated savings, and the withdrawal can be made in installments over a period of up to 10 years.

To qualify for partial pension withdrawal, beneficiaries must meet the following criteria: Continue reading

Zambia’s digital asset regulation tests framework

April 16, 2023 /Finance Technology/ — Zambia is currently testing a technology that would form the foundation of digital asset regulation. The tests are being conducted by the Bank of Zambia (BoZ) and the country’s securities regulator, the Securities and Exchange Commission (SEC).

The tests are designed to assess the feasibility of regulating digital assets in Zambia. They are also designed to identify any potential risks associated with digital assets and to develop mitigation strategies. Continue reading

Financial Literacy and Inclusion. How to ensure that financial services deliver for everyone.

LONDON, 13 April 2023 / Policy/ –Financial literacy and inclusion are essential for a strong and vibrant economy. When people have the knowledge and skills to manage their finances, they are better able to save, invest, and plan for the future. They are also less likely to fall into debt or become victims of financial fraud.

There are a number of things that can be done to improve financial literacy and inclusion. One is to provide more financial education in schools and workplaces. Another is to make financial products and services more accessible to everyone, regardless of income or background. Finally, it is important to break down the stigma associated with debt and financial hardship.

Here are some specific ways to improve financial literacy and inclusion: Continue reading

Impact of the Al Jazeera’s Gold Mafia Investigation in Africa and its leaders

LONDON, 13 April 2023 / — It is still too early to say what the full impact of Al Jazeera’s Gold Mafia investigation will be on Africa and its leaders. However, the investigation has already had a number of significant impacts. Continue reading

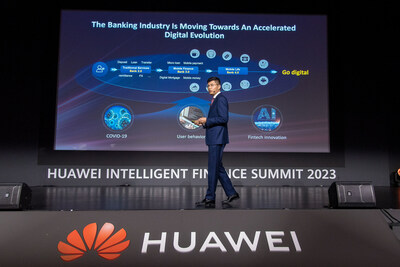

Industry players call for a ‘non-stop’ approach to Africa’s banking digitisation

If banks want to remain competitive in the face of neo-bank and fintech upstarts, they’ll have to fundamentally change the way they do business to be digital first. And if they’re going to achieve that goal, then working with technology partners to ensure that they have the right infrastructure in place will be crucial. That was the overriding message from the speakers at a media roundtable event hosted during the Huawei Intelligent Finance Summit for Africa 2023, recently held in Cape Town, South Africa. Continue reading