BizClik, a global B2B media and events company, announced the launch of the November 2025 editions of their FinTech portfolio, which includes FinTech Magazine and InsurTech Digital. The magazines feature exclusive insights from major industry leaders such as Coinbase, Block CEO Jack Dorsey, and Noto, with content focusing on global leaders, payments, open banking, and financial inclusion. Key articles examine topics like Neobanks, stablecoins, managing AWS costs in the Gen AI era, and fraud prevention. The announcement also promotes an upcoming event, FinTech LIVE: The US Summit, scheduled for February 2026, which will focus on themes driving transformation in the financial sector. The purpose of the magazines is to provide thought leadership and market insights for senior financial technology and insurance technology executives. Continue reading

Tag Archives: Financial services

nsave Launches Investment Platform

Jan. 11, 2025 /Mpelembe Media/ — nsave, a fintech company founded by former Rhodes Scholars, launched an investment platform offering safe, compliant overseas accounts and investments to individuals in high-inflation economies. This platform provides access to US equities, ETFs, and soon, funds, aiming to protect and grow wealth for those facing financial exclusion. Continue reading

Moniepoint Empowers Nigeria’s Underbanked Businesses With Financial Services Enabled by Google Cloud

Google Cloud announced today a new collaboration with Moniepoint, an Africa-focused business banking platform that provides financial services to Nigeria’s underbanked businesses residing in remote areas and communities. The collaboration makes financial services accessible at scale to millions of small and medium sized enterprises (SMEs) by bridging the banking gap in suburban locations. Continue reading

Why is J.P. Morgan helping First Republic Bank?

New York, May 1, 2023 – The U.S. banking crisis that began in March 2023 was the result of a number of factors, including:

The collapse of Silicon Valley Bank: Silicon Valley Bank was a large regional bank that specialized in lending to technology companies. The bank’s collapse in March 2023 was a major blow to the banking industry and shook confidence in the financial system.

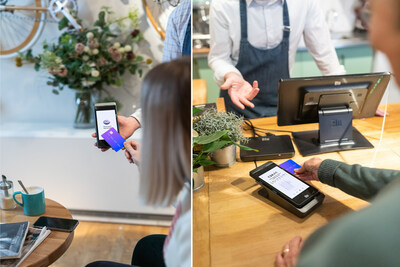

Viva Wallet and Elo partnership disrupts legacy checkout and embeds all payments into Elo mobile Android computers.

The strategic partnership between Viva Wallet, a leading European cloud-based neobank, and Elo, a leading global supplier of interactive touch solutions, is pioneering a new retail payments experience. European businesses can now offer new payment experiences, accepting Chip & PIN and Tap-on-Phone contactless payments by combining Viva Wallet’s cutting-edge embedded payments platform for smart devices, with Elo M50 and M60 Pay mobile computers in an enterprise-grade mobile point of sale system. One piece of technology that integrates smart retail software and payment acceptance for each and every transaction into a powerful and robust handheld Android computer; anywhere, anytime, seamlessly, all from the palm of your hand. Viva Wallet and Elo’s strategic alliance, featuring additional omnichannel solutions, has gone live in Europe with plans to expand globally, including the US. Continue reading

Square Software Turns Android Devices Into Powerful Payment Technology

SAN FRANCISCO–(BUSINESS WIRE)–Square today launched Tap to Pay on Android for sellers across the U.S., Australia, Ireland, France, Spain, and the United Kingdom. The new technology empowers sellers to securely accept contactless payments with a compatible Android device, and at no additional cost.

Continue reading

Silicon Valley Bank: how interest rates helped trigger its collapse and what central bankers should do next

Charles Read, University of Cambridge

A former prime minister of Britain, Harold Wilson, is famous for remarking that a week is a long time in politics. But in the world of finance, it seems everything can change in just two days.

HSBC will acquire the assets of SVB UK. Deposits will be protected

Here’s the HM Treasury statement:

Silicon Valley Bank (UK) Ltd has today been sold to HSBC. HSBC is headquartered in London, is the largest bank in Europe and is one of the world’s largest banking and financial services institutions, serving 39 million customers globally. Customers of SVB UK will be able to access their deposits and banking services as normal from today.

Continue reading

Lloyds Banking Group invests £10 million in digital identity company Yoti

Lloyds Banking Group has invested £10 million in digital identity company Yoti, an investment which supports the development of innovative technology to keep people safe online, tackle the ever-growing risks of identity fraud, and give people more control over their personal data. Continue reading

Flutterwave Secures Switching and Processing License, Nigeria’s Highest Payments Processing License

Flutterwave, Africa’s leading payments technology company has been granted a Switching and Processing License by the Central Bank of Nigeria (CBN)—widely regarded as CBN’s most valuable payments processing license. This license allows Flutterwave to offer transaction switching and card processing services to customers. Others include non-bank acquiring, agency banking and payment gateway services. Continue reading