April 25, 2023 /Finance/ — Open banking is a financial services term for the practice of allowing third-party financial service providers to access customer data held by other financial institutions, through the use of application programming interfaces (APIs). The goal of open banking is to promote innovation and competition in the financial services industry by giving consumers more choices and control over their financial data. Continue reading

Tag Archives: Payment systems

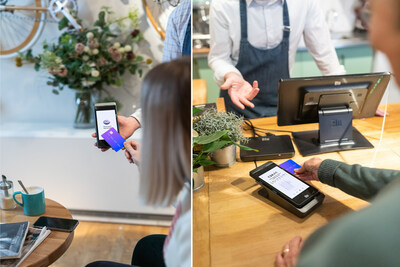

Viva Wallet and Elo partnership disrupts legacy checkout and embeds all payments into Elo mobile Android computers.

The strategic partnership between Viva Wallet, a leading European cloud-based neobank, and Elo, a leading global supplier of interactive touch solutions, is pioneering a new retail payments experience. European businesses can now offer new payment experiences, accepting Chip & PIN and Tap-on-Phone contactless payments by combining Viva Wallet’s cutting-edge embedded payments platform for smart devices, with Elo M50 and M60 Pay mobile computers in an enterprise-grade mobile point of sale system. One piece of technology that integrates smart retail software and payment acceptance for each and every transaction into a powerful and robust handheld Android computer; anywhere, anytime, seamlessly, all from the palm of your hand. Viva Wallet and Elo’s strategic alliance, featuring additional omnichannel solutions, has gone live in Europe with plans to expand globally, including the US. Continue reading

Square Software Turns Android Devices Into Powerful Payment Technology

SAN FRANCISCO–(BUSINESS WIRE)–Square today launched Tap to Pay on Android for sellers across the U.S., Australia, Ireland, France, Spain, and the United Kingdom. The new technology empowers sellers to securely accept contactless payments with a compatible Android device, and at no additional cost.

Continue reading

Japanese fintech leader Smartpay first to launch the next phase of digital consumer finance through open banking

Japan-based fintech Smartpay has launched Smartpay Bank Direct, the country’s first digital consumer finance service that allows customers to pay for online installment purchases straight from their bank accounts. Smartpay Bank Direct emphasizes user security while delivering convenience for the consumer, through a network of 67 partner banks across Japan[1]. Smartpay is Japan’s first digital consumer finance company to utilize Japan’s open banking system. Continue reading

Will South Africa’s street vendors go bust in a cashless world?

Kim Harrisberg Published: October 12, 2022

- Digital payments on the rise in South Africa

- People without mobile phones, bank accounts excluded

- Calls for innovation to include informal economy

JOHANNESBURG – For more than a decade, musician Thomas Nhassavele has been busking next to the parking payment machine at Johannesburg’s Rosebank Mall, where drivers often dropped their change into his guitar case. Continue reading

New Stellar Anchor Platform Bridges Businesses to the Blockchain and to a Global Network of Wallets and Exchanges

Today at Stellar’s 4th annual Meridian conference, the Stellar Development Foundation (SDF), the non-profit that supports the growth and development of the Stellar network, announced the launch of the Anchor Platform, an out-of-the-box solution that makes it easier and faster than ever for businesses to connect to the blockchain. In just three steps, companies such as banks and money transfer operators may access the Stellar network with reduced development cost and time. Continue reading

Flutterwave Secures Switching and Processing License, Nigeria’s Highest Payments Processing License

Flutterwave, Africa’s leading payments technology company has been granted a Switching and Processing License by the Central Bank of Nigeria (CBN)—widely regarded as CBN’s most valuable payments processing license. This license allows Flutterwave to offer transaction switching and card processing services to customers. Others include non-bank acquiring, agency banking and payment gateway services. Continue reading