The New York Stock Exchange’s (NYSE) second annual International Day event held at 11 Wall Street, hosted over 230 guests from 27 countries, including top investors, C-suite leaders, and the NYSE’s listed community. The event featured extensive programming on topics such as fintech and scaling beyond borders, with notable attendees including NBA legend Yao Ming and CNBC’s Jim Cramer. Several international companies, such as the apparel manufacturer Epic Group, AI-driven solutions provider IFS, and “phygital” company Smobler, were highlighted for discussing their growth and potential for listing on the exchange. The closing bell ceremony and social activities assert the NYSE’s strength in attracting international listings. Continue reading

Category Archives: Finance

J.P. Morgan 2026 Investment Outlook: AI, Fragmentation, Inflation

J.P. Morgan Private Bank published their 2026 Global Investment Outlook, titled “Promise and Pressure.” This outlook focuses on three key themes shaping investment opportunities: the Age of AI, which offers productivity gains but carries market risks; Fragmentation, referring to geopolitical shifts creating new regional investment dynamics; and persistent Inflation, driven by structural factors requiring portfolio stability beyond traditional bonds. The release features commentary from J.P. Morgan investment strategists providing region-specific insights for Europe, Latin America, and Asia, and details how Artificial Intelligence investment is accelerating rapidly. Continue reading

November FinTech Portfolio Launch Insights

BizClik, a global B2B media and events company, announced the launch of the November 2025 editions of their FinTech portfolio, which includes FinTech Magazine and InsurTech Digital. The magazines feature exclusive insights from major industry leaders such as Coinbase, Block CEO Jack Dorsey, and Noto, with content focusing on global leaders, payments, open banking, and financial inclusion. Key articles examine topics like Neobanks, stablecoins, managing AWS costs in the Gen AI era, and fraud prevention. The announcement also promotes an upcoming event, FinTech LIVE: The US Summit, scheduled for February 2026, which will focus on themes driving transformation in the financial sector. The purpose of the magazines is to provide thought leadership and market insights for senior financial technology and insurance technology executives. Continue reading

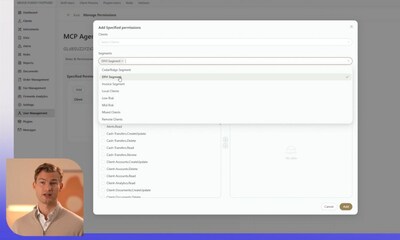

Performativ Unveils Compliant AI Agents for Financial Institutions

Performativ, a technology company, announced the launch of two new offerings: Custom Agents and the AgentKit Builder. These new capabilities are specifically designed to help financial institutions (such as banks and asset managers) safely and compliantly integrate artificial intelligence (AI) agents into their core operations and existing enterprise infrastructure. The solution is built to meet stringent regulatory oversight requirements, including those similar to the European AI Act, by ensuring all agent actions are logged, auditable, permissioned, and have traceability for regulatory review, thus transitioning enterprises from AI experimentation to secure, governed deployment. Continue reading

Wirex Forecasts Stablecoin Payments Revolution Under MiCAR

A new whitepaper from Wirex, a global stablecoin payments platform, forecasts a €1 trillion stablecoin market in Europe. The report, titled ‘Status of Digital Payments: Italy and Europe under MiCAR’, predicts that the European Union’s new MiCAR regulatory framework will propel significant growth in euro-denominated stablecoins and facilitate the rise of “agentic payments”, which are AI- and smart-contract-driven autonomous transactions. Wirex argues that MiCAR will act as a catalyst for innovation, leading to the emergence of stablecoin-native neobanks that offer programmable accounts and combine the programmability of crypto with regulated finance. Continue reading

Binance and GFI Launch Crypto Regulation Course

This curriculum is designed for compliance and regulatory professionals, offering insights into the rapidly changing digital asset landscape, including topics such as money laundering risks, investor protection, and real-world case studies like the FTX collapse. The collaboration strengthens an existing strategic alliance between Binance and GFI, which previously involved Binance sponsoring over 500 scholarships for a foundation programme in crypto regulation and compliance. Continue reading

EasyStaff Data: Stablecoins Skyrocket in Corporate Payroll

EasyStaff produced an exclusive data report about the rapid corporate adoption of stablecoins for payroll, noting a 6.8 times year-over-year growth in usage. This data highlights a significant shift away from traditional banking systems towards digital assets for international payments, including a 134% increase in the average corporate deposit size. Continue reading

Deutsche Börse Partners With Chainlink for Onchain Market Data

A new strategic partnership between Deutsche Börse Market Data + Services and Chainlink to publish multi-asset class market data on blockchains using a service called DataLink. This collaboration aims to connect traditional and blockchain-based financial markets by making real-time data from venues like Eurex, Xetra, 360T, and Tradegate accessible to thousands of decentralised finance (DeFi) protocols. Continue reading

SPAYZ.io White Paper on Payment Industry Challenges and Ambitions

SPAYZ.io, a global provider of advanced payment technologies, announced their new white paper titled “Winning Payments in Challenging Industries,” which explores the opportunities and challenges within the high-risk payments sector. Continue reading

Chainlink Solves Corporate Actions with AI and Blockchain

This solution leverages the Chainlink oracle platform, blockchain technology, and AI to standardise and streamline data validation, transforming unstructured announcements into verifiable, real-time records that can be distributed across both traditional financial infrastructure and blockchain networks. Key participants include institutions like DTCC, Swift, Euroclear, and UBS. Continue reading