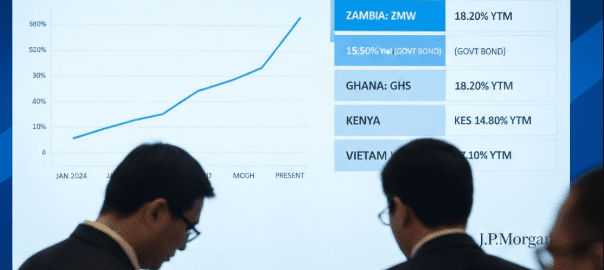

10 Feb. 2026 /Mpelembe Media — New Frontier Benchmark JPMorgan is finalizing plans to launch a new frontier market local currency debt index, aiming to formalize investment in high-yield, developing economies. Expected to include 20 to 25 countries, the index focuses on nations such as Egypt, Vietnam, Kenya, and Nigeria, which are anticipated to carry the heaviest weightings. This launch addresses growing investor appetite for riskier debt, with analysis suggesting that frontier local markets have systematically outperformed mainstream emerging market indices over the last eight years. Continue reading

Tag Archives: Debt relief

Debt dangers in Africa: how defaults hurt people, and why forgiveness isn’t the answer

Philippe Burger, University of the Free State

Public debt repayments in some African countries are at their highest levels since 1998. The Conversation Africa’s founding editor Caroline Southey talks to dean and economics professor Philippe Burger about the danger of debt problems some African countries face.

What is in Zambia’s debt restructuring proposal sent bondholders?

April 16, 2023 /Finance/ — If Zambia’s debt restructuring proposal is successful, it will help to improve the country’s economic outlook and create a more stable environment for businesses and investors. This will ultimately benefit the Zambian people by creating jobs, improving infrastructure, and providing access to basic services.

It is important to note that there are a number of risks associated with Zambia’s debt restructuring proposal. If the proposal is not successful, it could lead to a further deterioration in Zambia’s economy and could potentially lead to a default on Zambia’s debt.

Zambia sent a debt restructuring proposal to bondholders on April 14, 2023. The proposal includes the following key points: Continue reading

The whole world is facing a debt crisis – but richer countries can afford to stop it

Patrick E. Shea, University of Glasgow

Countries across the world are drifting towards a debt crisis. Economic slowdowns and rising inflation have increased demands on spending, making it almost impossible for many governments to pay back the money they owe.