April 19, 2023 /Economy/ — The cost of living crisis is a global issue, and it is having a significant impact on people in the UK. Energy bills, food prices, and fuel costs are all rising, and this is putting a strain on household budgets. There are concerns that the cost of living crisis could lead to social unrest, and there is no clear timeline for when this could happen.

Continue reading

Tag Archives: Economy

The National Pension Scheme Authority (NAPSA) of Zambia allows partial pension withdrawals

April 18, 2023 /Finance/ — The law allows NAPSA beneficiaries to withdraw a portion of their pension savings before they reach retirement age. The amount that can be withdrawn is limited to 50% of the accumulated savings, and the withdrawal can be made in installments over a period of up to 10 years.

To qualify for partial pension withdrawal, beneficiaries must meet the following criteria: Continue reading

Debt dangers in Africa: how defaults hurt people, and why forgiveness isn’t the answer

Philippe Burger, University of the Free State

Public debt repayments in some African countries are at their highest levels since 1998. The Conversation Africa’s founding editor Caroline Southey talks to dean and economics professor Philippe Burger about the danger of debt problems some African countries face.

Reasons why Purchasing-power parity is a better metric for comparing people’s well-being than Exchange rates

April 17, 2023 /Economy/ — Purchasing-power parity (PPP) is a measure of the value of different currencies, taking into account the cost of living in different countries. It is often used to compare the standard of living in different countries.

Exchange rates, on the other hand, are the prices of one currency in terms of another. They are determined by supply and demand in the foreign exchange market.

There are a few reasons why PPP is a better metric for comparing people’s well-being than exchange rates. Continue reading

Future of the dollar, as oil deals are increasingly done in other currencies

April 17, 2023 /Economy/ — The future of the dollar as the world’s reserve currency is uncertain. The dollar has been the world’s reserve currency for over 70 years, but there is a growing trend of countries using other currencies for oil deals. This trend is being driven by a number of factors, including the rise of China and other emerging economies, the increasing volatility of the dollar, and the desire of some countries to reduce their reliance on the United States.

Continue reading

What is in Zambia’s debt restructuring proposal sent bondholders?

April 16, 2023 /Finance/ — If Zambia’s debt restructuring proposal is successful, it will help to improve the country’s economic outlook and create a more stable environment for businesses and investors. This will ultimately benefit the Zambian people by creating jobs, improving infrastructure, and providing access to basic services.

It is important to note that there are a number of risks associated with Zambia’s debt restructuring proposal. If the proposal is not successful, it could lead to a further deterioration in Zambia’s economy and could potentially lead to a default on Zambia’s debt.

Zambia sent a debt restructuring proposal to bondholders on April 14, 2023. The proposal includes the following key points: Continue reading

Financial Literacy and Inclusion. How to ensure that financial services deliver for everyone.

LONDON, 13 April 2023 / Policy/ –Financial literacy and inclusion are essential for a strong and vibrant economy. When people have the knowledge and skills to manage their finances, they are better able to save, invest, and plan for the future. They are also less likely to fall into debt or become victims of financial fraud.

There are a number of things that can be done to improve financial literacy and inclusion. One is to provide more financial education in schools and workplaces. Another is to make financial products and services more accessible to everyone, regardless of income or background. Finally, it is important to break down the stigma associated with debt and financial hardship.

Here are some specific ways to improve financial literacy and inclusion: Continue reading

QBE AcceliCITY Resilience Challenge Now Accepting Applications

Now in its fifth year with Govtech accelerator partner Leading Cities, the QBE AcceliCITY Resilience Challenge is open to entrepreneurs whose ventures utilize smart-city solutions to address risk, equity and sustainability in urban environments. Primary challenge winners will receive up to $150,000 in prize money to fund a city pilot project, as well as publicity, mentoring and access to unique web-based courses. Continue reading

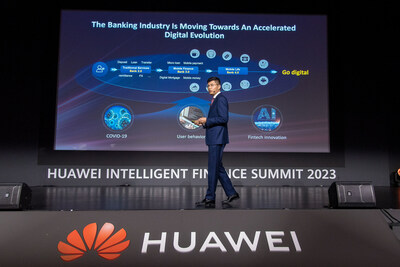

Industry players call for a ‘non-stop’ approach to Africa’s banking digitisation

If banks want to remain competitive in the face of neo-bank and fintech upstarts, they’ll have to fundamentally change the way they do business to be digital first. And if they’re going to achieve that goal, then working with technology partners to ensure that they have the right infrastructure in place will be crucial. That was the overriding message from the speakers at a media roundtable event hosted during the Huawei Intelligent Finance Summit for Africa 2023, recently held in Cape Town, South Africa. Continue reading

Equifax Introduces New OneScore Scoring Model to Help Expand Access to Credit and Drive Financially Inclusive Lending

Equifax® (NYSE: EFX) continues to support financially inclusive lending with the launch of OneScore, a new consumer credit scoring model that combines the company’s leadership in alternative data insights with the power of the Equifax Cloud™ to provide U.S. lenders and service providers with a more comprehensive financial picture of credit seeking consumers. OneScore is unique to the industry because it is the first single score to combine traditional credit history with telecommunications, pay TV and utility payment data on over 191 million consumers, as well as Equifax DataX and Teletrack specialty finance data on 80 million consumers – including payment history from non-traditional banks and lenders – potentially increasing credit scores by up to 25 points and the scorable population by more than 20 percent.