Equifax® (NYSE: EFX) continues to support financially inclusive lending with the launch of OneScore, a new consumer credit scoring model that combines the company’s leadership in alternative data insights with the power of the Equifax Cloud™ to provide U.S. lenders and service providers with a more comprehensive financial picture of credit seeking consumers. OneScore is unique to the industry because it is the first single score to combine traditional credit history with telecommunications, pay TV and utility payment data on over 191 million consumers, as well as Equifax DataX and Teletrack specialty finance data on 80 million consumers – including payment history from non-traditional banks and lenders – potentially increasing credit scores by up to 25 points and the scorable population by more than 20 percent.

Tag Archives: Money

Women only gained access to the London Stock Exchange in 1973 – why did it take so long?

James Taylor, Lancaster University

On March 26 1973, the London Stock Exchange admitted its first female members. This followed years of resistance, with London trailing behind other smaller exchanges around the UK.

That women had been excluded for so long was not only due to institutional misogyny. Research has shown how finance was imagined in sexist terms for centuries. And despite the extraordinary accomplishments of prominent female figures over the past 50 years, these biased beliefs persist to this day.

Silicon Valley Bank: how interest rates helped trigger its collapse and what central bankers should do next

Charles Read, University of Cambridge

A former prime minister of Britain, Harold Wilson, is famous for remarking that a week is a long time in politics. But in the world of finance, it seems everything can change in just two days.

Japanese fintech leader Smartpay first to launch the next phase of digital consumer finance through open banking

Japan-based fintech Smartpay has launched Smartpay Bank Direct, the country’s first digital consumer finance service that allows customers to pay for online installment purchases straight from their bank accounts. Smartpay Bank Direct emphasizes user security while delivering convenience for the consumer, through a network of 67 partner banks across Japan[1]. Smartpay is Japan’s first digital consumer finance company to utilize Japan’s open banking system. Continue reading

Ramon Pedrosa-Lopez New Book “The Philosophy of Investor Relations” Now Available

Renowned business leader and author Ramon Pedrosa-Lopez has released his latest book, “The Philosophy of Investor Relations”, a thought-provoking exploration of the role of investor relations in the contemporary stock market world. Continue reading

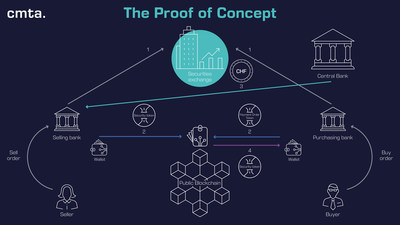

The Swiss financial industry has successfully traded and settled tokenized investment products

For the first time, key players in the Swiss financial industry successfully developed and tested a novel settlement mechanism for tokenized investment products on a public blockchain testnet infrastructure. A smart contract, developed by the Capital Markets and Technology Association (the CMTA), allows for streamlined processes, reduces complexity, raises security, and eliminates counterparty risks from trades. The CMTA’s proof of concept marks a milestone for the Swiss financial industry. Continue reading

Wirex Launches 52 Tokens for Accessing Web3

Wirex, a banking alternative built for Web3, has listed 52 new tokens on their app. The cryptocurrencies will provide their 5 million customers straightforward access to the benefits of DeFi. Continue reading

FTX collapse crushes crypto dreams in Africa and beyond

- FTX’s bankruptcy hurts small investors across the world

- Young African crypto backers fret about damage to sector

- Regulators repeat warnings about risks of crypto dealing

LAGOS/BANGKOK – Days before his FTX cryptocurrency exchange collapsed, co-founder Sam Bankman-Fried tweeted “Hello, West Africa!” – his latest nod to a region where a growing number of kitchen table investors had put their faith, and savings, in FTX.

Continue reading

Elon Musk takes Twitter private – here’s what that means for the company and its chances of success

Elon Musk has said he intends to complete his purchase of Twitter after earlier trying to wriggle out of the deal.

Patrick Pleul/Pool via AP

Erik Gordon, University of Michigan

Elon Musk has finally completed his US$44 billion deal to acquire Twitter and take it private.

Will South Africa’s street vendors go bust in a cashless world?

Kim Harrisberg Published: October 12, 2022

- Digital payments on the rise in South Africa

- People without mobile phones, bank accounts excluded

- Calls for innovation to include informal economy

JOHANNESBURG – For more than a decade, musician Thomas Nhassavele has been busking next to the parking payment machine at Johannesburg’s Rosebank Mall, where drivers often dropped their change into his guitar case. Continue reading