Wirex, a leader in digital payment solutions, proudly announces W-Pay, a cutting-edge Zero-Knowledge (ZK)-powered App Chain poised to transform the landscape of global payments. Designed to seamlessly connect decentralised applications, non-custodial wallets, and traditional payment infrastructures, W-Pay heralds a new era of efficiency and security in financial transactions. Continue reading

Category Archives: Finance

Surveillance in the age of WhatsApp webinar by the London Stock Exchange Group of companies (LSEG)

The key takeaways of the “Surveillance in the age of WhatsApp” webinar by the London Stock Exchange Group of companies (LSEG) are as follows: Continue reading

Wealthy…not rich.

Sept. 5, 2023 Finance/ — The concept of wealth and not rich is a complex one that is often misunderstood. In Africa, there is a strong emphasis on wealth and material possessions. This is due to a number of factors, including the history of colonialism, the legacy of poverty, and the desire to achieve social status. Continue reading

Wirex chooses Polygon CDK to build its upcoming payment-focused App Chain

Wirex, a global leader in crypto payments with over 6 million users, is using the Polygon CDK (Chain Development Kit) to build its payments-focused App Chain (W-Pay). Wirex has opted to use the Polygon CDK, an open-source codebase for launching ZK-powered L2 chains for Ethereum, on demand, to build its own payments-focused L2. All chains deployed using Polygon CDK are interoperable, with automatic access to the unified liquidity of all Polygon chains, and one-click access to the entire liquidity of Ethereum. They also offer the enhanced security of zk proofs and near-instant finality. Continue reading

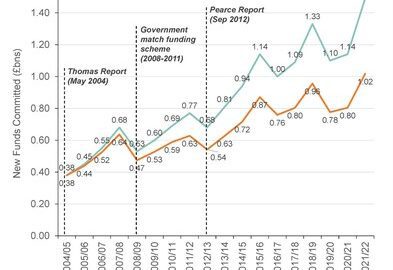

CASE and More Partnership release joint study of fundraising trends in UK higher education

The Council for Advancement and Support of Education (CASE) and More Partnership have joined forces to reprise an important look at a decade of fundraising trends within the UK higher education sector. The findings and recommendations have wide-ranging implications for the sector, and beyond. Continue reading

The Fintech Fueling Europe’s Digital Currency Revolution: Perfinal’s Role in Europe’s first Live CBDC Project

Europe has recently witnessed the launch of its first live Central Bank Digital Currency (CBDC) project launched by The Central Bank of Hungary, with Perfinal taking center stage as the fintech backbone of this monumental transition. This remarkable initiative places Perfinal at the forefront of a digital currency revolution, as the financial world grapples with blending traditional mechanisms with new-age digital innovations. Continue reading

Mastercard selects Fluency as its New CBDC Partner

Mastercard, a global leader in payment solutions, recently announced Fluency as its CBDC partner, as part of plans to capitalise on the growing interest in CBDCs. https://mpelembe.net/index.php/uk-business/?rkey=20230818EN88111&filter=9768

The “Digital Wallet Race” Intensifies as Banks and Fintechs in Europe and Around the World Invest in Insurance: Chubb Survey

A new survey from Chubb, the world’s largest publicly traded property and casualty insurance company, reveals that a majority (56%) of financial executives involved in insurance decision-making globally expect to generate more than 10% of their revenue from embedded insurance within three years. Today, just 11% of firms in Europe report that level of revenue, compared to 20% globally, but 62% say their customers are interested in obtaining embedded insurance. Continue reading

XRP is going to the moon

July 13, 2023 /Developers/ —There are a few reasons why XRP is soaring today. Continue reading

Flutterwave Launches Tuition to Ease Education Fee Payments for Africans Abroad and on the Continent

Flutterwave, Africa’s leading payments technology company, has launched Tuition, a new payment product, to allow African users to conveniently pay various fees to educational institutions within Africa and overseas using their local currencies. The educational institutions available on Tuition include high schools, universities, colleges and some global edutech platforms. Continue reading