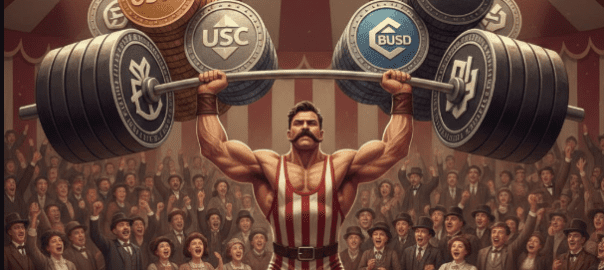

Stablecoins Come of Age: Navigating Landmark Regulations, Global Adoption, and the Rise of Yield-Bearing Tokens

Feb 19, 2026 /Mpelembe media/ — By late 2025 and early 2026, the global stablecoin market has transitioned from a niche crypto-trading utility into core financial infrastructure, processing trillions of dollars in annual transaction volume. This evolution is defined by the implementation of landmark regulatory frameworks—most notably the U.S. GENIUS Act and the EU’s MiCA regulation—which have established strict operational standards and legitimized the asset class. Simultaneously, the market has seen a surge in institutional adoption and a significant structural shift toward yield-bearing and synthetic stablecoin models. However, despite these advancements, recent market shocks underscore that systemic vulnerabilities, such as liquidity crunches and de-pegging risks, remain persistent threats. Continue reading