Category Archives: Business

Following the Money: The Unraveling of Jeffrey Epstein’s Elite Enablers

23 Feb. 2026 /Mpelembe Media — The provided sources detail the immense global fallout following a massive 2026 Department of Justice document release concerning deceased sex trafficker Jeffrey Epstein. Government investigations and news reports highlight how JPMorgan Chase executives reportedly ignored internal alarms to facilitate Epstein’s financial activities for nearly two decades. The materials reveal a vast network of enablers, leading to the arrest of Andrew Mountbatten-Windsor and the resignations of prominent figures like Goldman Sachs lawyer Kathryn Ruemmler and UK Ambassador Peter Mandelson. Academic institutions like Harvard, Columbia, and UCLA are also facing internal reckonings as files expose deep ties between Epstein and various professors or donors. While the FBI maintains there is no evidence of a specific “client list” or blackmail, the documents have sparked a wave of accountability across global politics, finance, and elite social circles. Ultimately, the sources illustrate a systemic failure of high-level oversight that allowed Epstein to maintain influence long after his initial criminal convictions. Continue reading

The Great Tariff Refund: Navigating the Supreme Court Ruling

The $180 Billion Reversal: What the SCOTUS Tariff Ruling Actually Means for the Future

Feb 20, 2026 /Mpelembe media/ — On February 20, 2026, the U.S. Supreme Court issued a landmark 6-3 decision in the consolidated cases of Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., striking down the sweeping global tariffs implemented by the Trump administration. Chief Justice John Roberts authored the majority opinion, which ruled that the International Emergency Economic Powers Act (IEEPA) does not grant the President the authority to unilaterally impose tariffs. The Court emphasized that while IEEPA allows the President to “regulate” commerce during national emergencies, it does not transfer Congress’s exclusive constitutional power to levy taxes and duties to the Executive Branch. Continue reading

The Machine Economy: Why Crypto Was Built for AI agents

The Rise of the Machine Economy: 5 Startling Realities of the New Crypto-AI Frontier

Feb 20, 2026 /Mpelembe media/ — The integration of AI agents and blockchain technology is driving a transition toward an “Agentic Economy,” where machines operate as autonomous, sovereign economic actors. Traditional financial infrastructure, with its high fixed fees, minimum balance requirements, and human-centric legal identity hurdles, cannot support the high-frequency, sub-cent microtransactions that AI agents require. Instead, blockchains provide a permissionless, 24/7 settlement layer where agents can use stablecoins to autonomously pay for APIs, compute power, and data

Continue reading

NeoSentinel-01: Architecture and Security Audit of Autonomous Economic Agents

The Sentinel Evolution: From Orbital Radar to Sovereign Digital Agents

Feb 19, 2026 /Mpelembe media/ — The archetype of the “Sentinel” has undergone a profound metamorphosis. Traditionally, the watchman was a human atop a tower, limited by biological fatigue and the reach of the naked eye. Today, the Sentinel has evolved into a multi-layered Hyperstructure —a synthetic ecosystem of intelligence that operates where humans cannot.From the vacuum of Low-Earth Orbit (LEO) to modular ground-based rovers and autonomous economic agents in the digital substrate, we are witnessing the birth of a world that never sleeps. This is the era of autonomous oversight, where silicon stands guard over the physical and digital economy alike. Continue reading

The $33 Trillion Shift: 5 Surprising Realities Reshaping the Stablecoin Era

Stablecoins Come of Age: Navigating Landmark Regulations, Global Adoption, and the Rise of Yield-Bearing Tokens

Feb 19, 2026 /Mpelembe media/ — By late 2025 and early 2026, the global stablecoin market has transitioned from a niche crypto-trading utility into core financial infrastructure, processing trillions of dollars in annual transaction volume. This evolution is defined by the implementation of landmark regulatory frameworks—most notably the U.S. GENIUS Act and the EU’s MiCA regulation—which have established strict operational standards and legitimized the asset class. Simultaneously, the market has seen a surge in institutional adoption and a significant structural shift toward yield-bearing and synthetic stablecoin models. However, despite these advancements, recent market shocks underscore that systemic vulnerabilities, such as liquidity crunches and de-pegging risks, remain persistent threats. Continue reading

Green Gold and Grey Zones: Africa’s Uneven Pivot from Prohibition to Industrial Powerhouse

Africa’s Billion-Rand Botanical Blueprint: Bridging Ancient Ethnobotany and the Industrial Hemp Revolution

Feb 17, 2026 /Mpelembe media/ — The African cannabis landscape is undergoing a historic structural transformation, shifting from a century of colonial-era prohibition toward a sophisticated, multi-tiered regulatory environment driven by economic necessity and industrial innovation. As of 2025/2026, the continent is positioning itself as a critical supplier to the global legal market—projected to reach $50 billion by 2027—while grappling with significant internal challenges regarding social equity and regulatory coherence. Continue reading

Ripple’s $40 Billion IPO: Short-Term Hype vs. Long-Term Reality for XRP

The $40 Billion Disconnect: Why Ripple’s Record IPO Valuation Might Not Save XRP

Preparing for an IPO with a valuation nearing a record $40 billion, driven by its expanding footprint with global banking giants. This valuation secures Ripple’s status as a “unicorn company” (a startup valued over $1 billion). Continue reading

Mining Indaba 2026: Project Vault, Policy Reform, and the Push for African Industrialization

The Billion-Dollar Handshake: Why the World’s Diamond Giants are Finally Teaming Up

10 Feb. 2026 /Mpelembe Media — The 2026 Investing in African Mining Indaba is currently underway in Cape Town, South Africa, operating under the theme “Stronger Together: Progress Through Partnerships”. The event has attracted record attendance, including 58 government ministers and two heads of state, amidst an intensifying geopolitical race for critical minerals. Continue reading

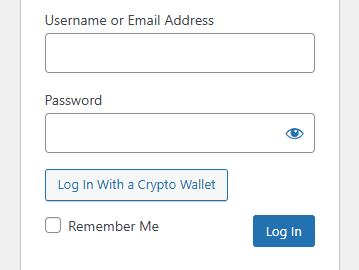

Collaboration with AI Agents at Mpelembe.net is verified by Google

From Blind Trust to Verifiable Proof: Securing the Agentic Economy with Decentralized Identity and Zero-Knowledge Privacy

10 Feb. 2026 /Mpelembe Media — Crypto wallets enable AI agents to function as autonomous entities by serving as their financial and legal identity. This infrastructure allows agents to move beyond simple chatbots and become independent economic actors capable of managing complex workflows without constant human intervention.